Articles

Articles (page 119)

-

Obamacare FAIL

The Obama Administration would have you believe repealing the Affordable Care Act (ACA) is a political and legislative long shot,…

-

State of the State: Kansas

Kansas’ economy is primed for strong growth. To sustain its tax cuts and create greater economic opportunity, Kansas must implement stronger spending reforms, as other tax-cutting states like North Carolina have done.

-

State of the State: Vermont

In his final State of the State address, Governor Peter Shumlin outlined his 2016 agenda and discussed fiscal policies such…

-

The Untouchables: A Look at Local Retirement Systems Protected by State Law

Many of Texas’s local retirement systems are in danger of fiscal disaster. The latest data shows we have in excess…

-

State of the State: Washington

“Our economy is not working for everyone.”

-

Rally for Rebecca

On a freezing Monday morning, dozens of teachers, parents and policymakers gathered on the steps of the United States Supreme…

-

Dark Clouds, Silver Linings and Autonomous Vehicles

Every dark cloud has its silver lining. But when the dark cloud means snow, ice, and other bad weather, what…

-

Spending vs. Taxation: Does the Conservative Texas Budget Meet the Needs of Texans?

A child’s education is one of the many things that can’t get funded unless the state’s budget is passed, making…

-

State of the State: Arizona

As the states begin their 2016 legislative sessions, governors are beginning to outline their agendas with their state of the…

-

What State Legislatures are Doing to Protect Academic Freedom

Given recent campus protests, it is worth noting the efforts state legislatures are making to increase academic freedom at public…

-

Compassion or Barriers?

Which is compassionate: indicating a desire to increase access to mental health treatment for those in need of help, or…

-

Friedrichs v. California Teachers Association

Friedrichs v. California Teachers Association et al. is a case in front of the U.S. Supreme Court filed by the…

-

State Budget Solutions

Every year budgets are debated and voted upon somewhere across our nation. The timing of state budgets generally occurs during the summer months, since almost all states have a fiscal year that begins on July 1st. This is the single most important job for a state government to accomplish each year: prioritizing public priorities by allocating precious tax dollars amongst competing claims by lawmakers, special interests and citizens.

-

ALEC Members Tour Palo Verde Nuclear Generating Station

Early last month, ALEC convened at the 2015 States and Nation Policy Summit in sunny Scottsdale, AZ. In conjunction with…

-

Are You Living in a Judicial Hellhole™?

Judicial Hellholes™ are litigious environments where excessive lawsuits abound and civil justice is out of balance. Judges and courts apply…

-

Congress Trades Obamacare for $516 Billion in Tax Savings

The report, which was jointly reviewed by the CBO and staff from the Joint (Congressional) Committee on Taxation, considered the estimated cost of repealing Obamacare would have on both federal revenue and deficit spending, as well as parts of the U.S. economy if put into effect beginning 2018 through 2026. This is the first time a measure for repeal of the ACA will reach the President’s desk since being signed into law March 23, 2010.

-

Inez Feltscher Defends School Choice in O.C. Register

Board members of the Anaheim Union High School District and Superintendent Michael Matsuda took to the Voice of OC news…

-

Supreme Court Set to Review Forced Union Contributions from Teachers

Teachers’ unions, like other unions, spend a great deal of money engaging in explicitly political activity like lobbying legislators and supporting candidates. Teachers’ unions have so far represented the strongest political challenge to transformative education reform, such as charter schools, voucher programs and education savings accounts. Unfortunately, that clout is built, at least in part, on the forced contributions of teachers who do not necessarily agree with the actions of the unions.

-

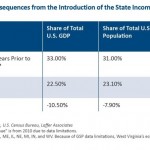

The Worst Tax Policy Idea of 2015

Our nomination for the worst tax policy idea of 2015 goes to Alaska Governor Bill Walker for his proposal to reestablish the state’s personal income tax. This proposal would turn back the clock 35 years on economic development in the state and would cause significant harm to Alaska’s economic outlook. Alaska faces a $3.5 billion budget gap due to declining oil prices and years of overspending. While there may be tough choices ahead to put Alaska on the path back to balanced budgets and a healthy economy, a personal income tax will only add to the fiscal challenges for Alaska’s hardworking taxpayers.

-

Bard College: “Drone Sightings and Close Encounters with Airplanes on the Rise”

A recent study from the Bard College Center for the Study of the Drone evinces an increase in the…