New Report Quantifies Total Incentives Offered to Rooftop Solar Customers

Our friends at the Consumer Energy Alliance (CEA), a nonprofit, nonpartisan organization representing the interests of energy consumers, recently released a report that attempts to quantify the total amount of incentives available to those customers who opt to install rooftop solar photovoltaic (PV) systems. The report – titled Incentivizing Solar Energy: An In-Depth Analysis of U.S. Solar Incentives – draws upon data from 15 states[i] that were selected in order to account for diversity in geography, solar incentives, rate designs and wholesale electricity rates across the country.

The four primary incentives available to rooftop solar customers are:

- Direct incentives. These typically take the form of tax credits or deductions from federal and state governments. All distributed generation (DG) customers receive the Residential Energy Efficiency Property Credit (REEPC), a federal tax credit equal to 30 percent of installation costs of the PV system. This credit is similar in nature to the investment tax credit (ITC) currently afforded to utility-scale solar facilities. In addition, depending on the state or locality, customers can take advantage of a variety of income, sales and property tax deductions or exemptions.

- Net energy metering (NEM) incentives. Currently, 44 states and the District of Columbia offer net metering programs to DG customers. The programs allow customers to receive a bill credit for any surplus electricity generated from their PV systems. These credits are typically higher than a utility’s avoided cost and allow customers to avoid paying for the maintenance of and services provided by the electric grid.

- Third party ownership (TPO) incentives. Many states now allow third-party businesses to install PV systems on a homeowner’s roof. The third party can then either lease the panels to the homeowner or sell the electricity directly to the homeowner through a long-term contract. The fair market value of these systems is typically higher than the installed cost, allowing greater access to the direct incentives offered by governments. Further, the TPO can depreciate the rooftop solar panels as a business asset after just five years.

- Renewable energy certificates (RECs). RECs are tradeable energy commodities that can represent one megawatt-hour (MWh) of electricity generated from a renewable source. These are valuable (and can oftentimes be sold at inflated, above-market rates) because states with renewable portfolio standards (RPS) can purchase them in order to satisfy the mandate.

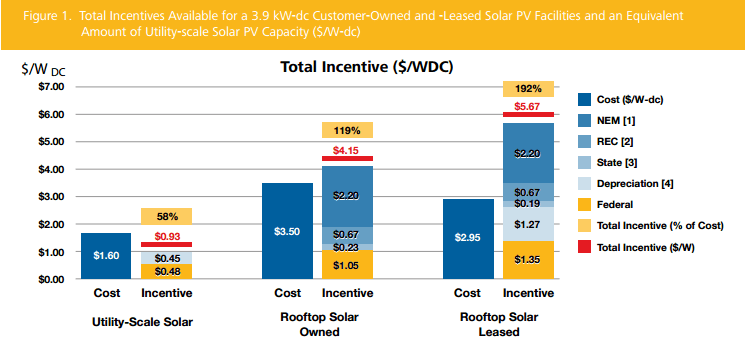

The quantitative total of these incentives are reflected in the chart below:

A couple things immediately jump out. First, the incentives offered for rooftop solar are significant. Incentives for systems owned by homeowners or leased to homeowners by a third party are oftentimes greater than the total installation cost. As a result, the viability of the rooftop solar industry remains very much beholden to government incentives. That rooftop solar companies earlier this year threatened to leave Nevada after the Public Utilities Commission of Nevada (PUCN) approved a new net metering rate structure is further evidence of this fact.

During the last few years, the cost of rooftop has dropped significantly. In 2007, the median cost of rooftop solar was about $9 per Watt DC. By 2013, this number had fallen to under $5, representing a 44 percent drop in roughly six years. In light of these cost reductions and increased market penetration of rooftop solar, policymakers should be encouraged to reconsider the value and effectiveness of considering to offer such generous incentives.

[i] Arizona, California, Connecticut, Florida, Georgia, Illinois, Louisiana, Maine, Massachusetts, Michigan, Minnesota, New Hampshire, New Jersey, Nevada and North Carolina.