Fiscal Rules: An Important Step on the Path to Responsible Fiscal Policy

Government spending is at an all-time high, and with the federal debt reaching its highest levels since World War II, and state government spending has risen more than 90% in the past 40 years, taxpayers are on the hook to support this out-of-control spending.

Colorado’s Taxpayers Bill of Rights – or TABOR for short – is a state law that places restrictions on spending growth. Approved by voters in 1992 as an amendment to the state constitution, TABOR is considered the gold standard of state fiscal rules because it limits the growth of most of Colorado’s spending and revenue to inflation plus population. If the state government collects more tax dollars than TABOR allows, the money is returned to taxpayers as a TABOR refund.

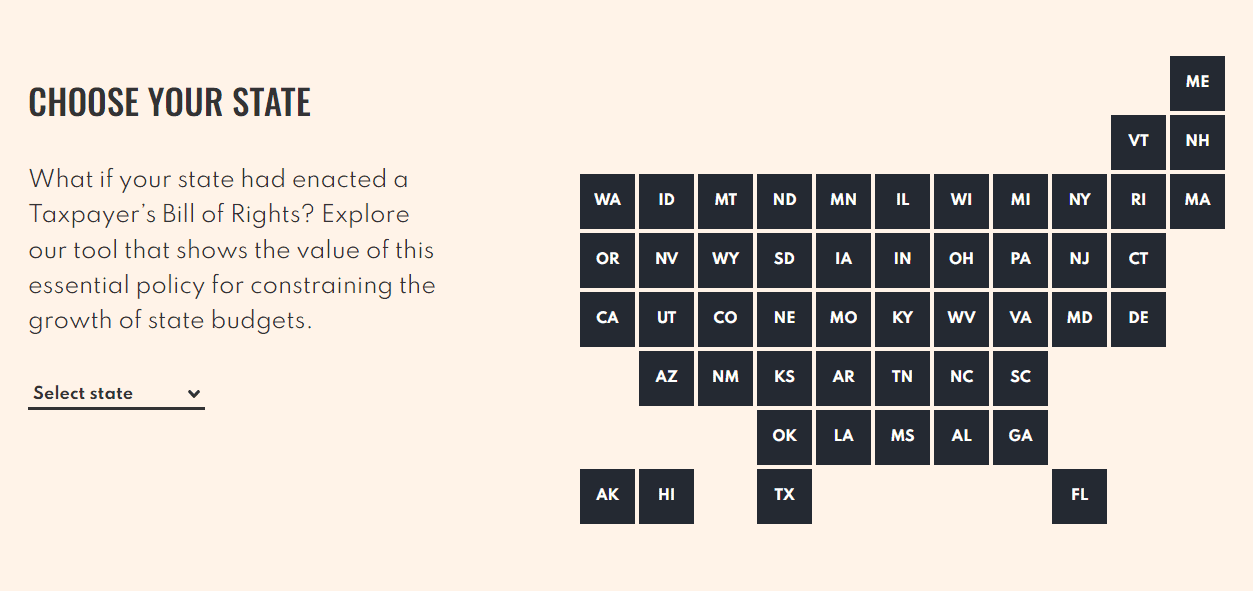

Now, the new ALEC Fiscal Rules website, FiscalRules.org, shows you how much money your state would have saved with TABOR. Working alongside fiscal rules experts – Dr. Barry Poulson and Dr. John Merrifield – this project is part of their ongoing educational efforts on fiscal rules, such as Vet Fiscal Rules and their book A Fiscal Cliff: New Perspectives on the U.S. Federal Debt Crisis.

This website is easy to use. Pick your state, the year the hypothetical TABOR was enacted, and whether you want it to apply TABOR to the general fund or all state spending. Once you make your selections, our model will show you how much your state would have spent if TABOR were enacted and how much money it would have saved taxpayers.

Most state governments will benefit tremendously from enacting a fiscal rule like TABOR. As our data shows, the size of state government spending has massively increased by more than 90% in the past four decades, even after accounting for inflation and population growth.

One such example is Nevada. Nevada spending levels climbed by 289%. Even though both Nevada has a statutory tax and expenditure limitation (TEL) that is nowhere near as strong as TABOR because it only applies to the general fund and requires a supermajority in the legislature to raise taxes. Critics may also note that the Gann Amendment in California, once as strong as TABOR, has been given so many exemptions that today the TEL is not worth the paper it’s printed on.

In addition to fiscal rules, states should adhere to priority-based budgeting principles, as well as other reforms noted in the ALEC State Budget Reform Toolkit. Priority-based budgeting starts with these key questions for state policymakers:

- What is the role of government?

- What are the essential services government must provide to fulfill its purpose?

- How will we know if government is doing a good job?

- What should all this cost?

- When cuts must be made, how will they be properly prioritized?

This process takes longer than the current method of automatic increases, but it is worth it. Better fiscal management means that state policymakers will be more prepared to weather unexpected economic downturns. By focusing on the core functions of government and the respective costs, state policymakers will find that they will not need to take on billions of dollars in debt to finance current spending.

If you are a state legislator who wants to learn more about how well-designed fiscal rules can positively impact your state, please reach out to the ALEC team. Our staff at the Center for State Fiscal Reform, alongside Dr. Poulson and Dr. Merrifield, are eager to continue our educational efforts to protect taxpayers through TELs.