Comparing the Effects of Tax Reform in Nebraska: Income Taxes vs. Sales and Use Taxes

A recent study by the Nebraska Department of Revenue (DOR), (1) intended to inform the members of Nebraska’s Commission on Tax Modernization, confirms what progrowth tax reformers have long argued: tax cuts lead to personal income growth, investment growth, and job growth. Though the study incorrectly found sales tax cuts to be a greater boon to state economic performance than income tax cuts, the study notes that even after accounting for offsetting cuts to government spending, tax cuts of any kind would provide a boost to Nebraska’s economy.

At the direction of the Nebraska legislature, the DOR compared the presumed economic consequences of a static $100 million initial revenue cut from both an income tax cut and a sales tax cut. The study then goes on to project the job growth, income growth, investment growth, and offsetting tax revenue (known as the Laffer effect based on the Laffer curve [2]) the state could expect from a tax cut. The study suggests that a sales and use tax cut would outperform an income tax cut in every category.

Ironically, big government groups typically opposed to tax cuts have touted the study, (3) despite the fact these groups usually claim that tax cuts have little or no effect on economic performance. In this instance they are right to promote a study that correctly shows that tax cuts create jobs and boost personal incomes, but unfortunately “bury the lede” and instead grasp onto the study’s incorrect conclusions on the comparative power of income taxes versus sales taxes to generate growth.

It is worth noting the study is not actually a review of past results, but rather a model relying on assumptions to generate projected outcomes. This is in contrast to an econometric study, which looks at past economic events and attempts to draw correlations between relevant variables. A model is only as good as its assumptions, and the DOR model’s assumptions are a mixed bag. The assumption that tax cuts generally lead to economic growth is a good one, and supported by the vast majority of empirical evidence on the strong connection between taxes and growth. (4) The model also rightly assumes that tax cuts have revenue offsets, known as the Laffer effect, which are generated by dynamic tax scoring.” (5) On the other hand, the assumption on the relative success of income tax cuts versus sales tax cuts (greater revenue offset, higher personal income growth, higher job growth, higher investment growth, higher job growth) is plagued with issues.

In general, the study is heavy on the “demand side” assumptions and light on the “supply side” assumptions. The study finds bigger benefits from the additional spending that goes on in an economy after a tax cut, therefore “stimulating” the economy (demand side), and lower impact from the incentives for higher levels of work, production, and investment that a lowering of marginal rates of an income tax generate (supply side). We have previously pointed out the supply side case for growth:

The economic case that taxes negatively affect growth rests on the notion that taxes lower the return for productive activity like work, production, and innovation. Lowering the return to such productive activity—activity which often involves substantial difficulty and sacrifice—leads people to engage in that activity less frequently. Moreover, those businesses and highly talented individuals with the greatest ambition and will to succeed are likely to take their opportunity or talent to greener pastures—states or nations with more favorable business climates. (6)

The DOR assumes that any increased disposable income a family receives as a result of a sales tax would immediately be spent in Nebraska, while any additional income the same family had as a result of an income tax reduction would be invested outside of the state. This despite the fact that many small businesses filing in the state income tax code as “passthrough entities” would likely reinvest much of their tax savings in their small business and not global capital markets. Moreover, they assume a much larger stimulative effect from the additional spending enabled by a sales tax cut than they do the additional spending and incentives to work and invest enabled by income tax cuts. This gives short shrift the increased supply of labor or capital that would be available in the Nebraska economy if each hour of work and productivity were more valuable as a result of an income tax reduction. The DOR model, like so many before it, says that a taxpayer is only as valuable as the money they spend, not the labor they create.

Instead, let’s look at the Organisation for Economic Cooperation and Development (OECD)’s seminal empirical study (7) of the correlation between tax rates and growth in 21 countries over 33 years. The study, which is indeed a study of past performance rather than a speculative assessment, found that all taxes harm economic growth. Or rather, that any tax cut improves economic growth, as the DOR model corroborates. The strongest correlation was between income (personal and corporate) taxes and growth, that is, that higher income taxes resulted in lower growth rates. On the other hand, consumptionbased taxes such as the sales tax resulted in less of a drag on growth. This conclusion is echoed in a multitude of studies examining the relationship between taxes and growth. (8)

Or separately, one can consider a paper by former Council of Economic Advisors Chairman, N. Gregory Mankiw, published along with Matthew Weinzierl for the National Bureau of Economic Research. The paper is widely considered a fair estimate of revenue offsets for dynamic scoring on both the right and left. In “Dynamic Scoring: A Back of the Envelope Guide,” (9) Mankiw and Weinzierl demonstrate that traditional economic models under a wide variety of alternative assumptions suggest that taxation of labor will have a 17 percent offset (nearly triple the Nebraska DOR’s estimate) and nearly 50 percent for taxation of capital, in the long run. Though the study only looks at one year of the short run effect of a income tax cut, the model certainly understates the power of progrowth, supplyside tax cuts to boost the Nebraskan economy.

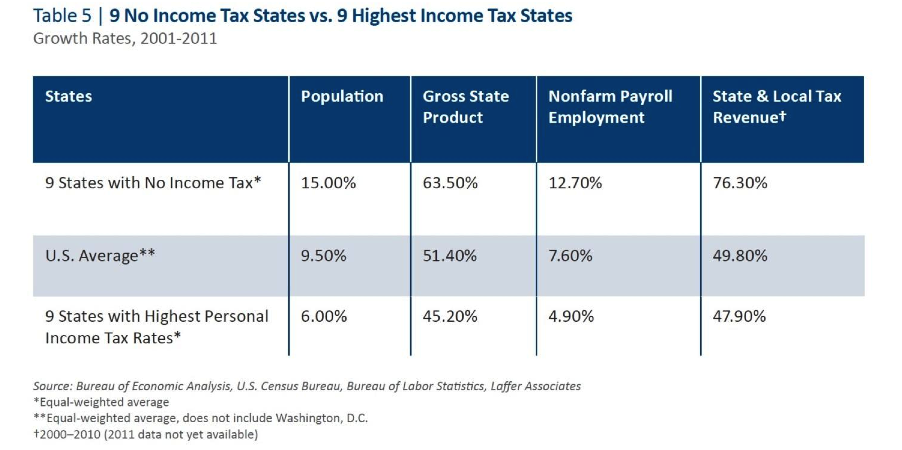

In Rich States, Poor States, (10) we compare the nine highest income tax states with the nine states with no income taxes, and find that economic performance is significantly higher in no income tax states:

The DOR model, even for wants of supply side assumptions, echoed the key result that the OECD study, along with the vast majority of studies examining the topic, detailed: All taxes harm economic growth. Tax cuts to any revenue source result in higher personal income, increased investment in the state, more jobs, and offsetting revenue for the state, making tax cuts less limiting to the state budget than they might first appear.

As Nebraskans consider tax reform, they should consider this study by their DOR with a grain of salt. They will not get more economic growth from a sales tax than an income tax, but they will benefit from nearly any tax cut enacted.

Footnotes

1. “2010 Nebraska Tax Burden Study.” Nebraska Department of Revenue. November 1, 2013. [URL: http://www.revenue.nebraska.gov/research/2010TaxBurdenStudy.pdf]

2. “The Laffer Curve.” Laffer Center at the Pacific Research Institute. [URL: http://www.laffercenter.com/thelaffercenter2/thelaffercurve/]

3. “Department of Revenue study shows income tax cut no boon for Nebraska.” OpenSky Policy Institute. November 7, 2013. [URL: http://www.openskypolicy.org/department-of-revenue-study-shows-income-tax-cut-no-boon-for-nebraska]

4. McBride, William. “What is the Evidence on Taxes and Growth?” Tax Foundation. December 18, 2012. [URL: http://taxfoundation.org/article/whatevidencetaxesandgrowth]

5. Prante, Gerald. “Resources on the Dynamic Scoring Issue.” Tax Foundation. May 17, 2006. [URL: http://taxfoundation.org/blog/resourcesdynamicscoringissue]

6. Klein, Fara and Will Freeland. “Myth of the Day: Raising Tax Rates Will Not Harm Economic Growth.” American Legislator. American Legislative Exchange Council. March 11, 2013. [URL: http://www.americanlegislator.org/mythofthedayraisingtaxrateswillnotharmeconomicgrowth/]

7. Arnold, Jens. “Do Tax Structures Affect Aggregate Economic Growth?: Empirical Evidence from a Panel of OECD Countries.” Organisation for Economic Cooperation and Development. Economics Department Working Papers, No. 643. October 14, 2008. [URL: http://search.oecd.org/officialdocuments/displaydocumentpdf/?doclanguage=en&cote=eco/wkp(2008)51]

8. See McBride, “What is the Evidence on Taxes and Growth?”, supra note 4.

9. Nesvisky, Matt. “Dynamic Scoring: A BackoftheEnvelope Guide.” The National Bureau of Economic Research. July 2005. [URL: http://www.nber.org/digest/jul05/w11000.html]