Pension Reform: Polling and Millennials

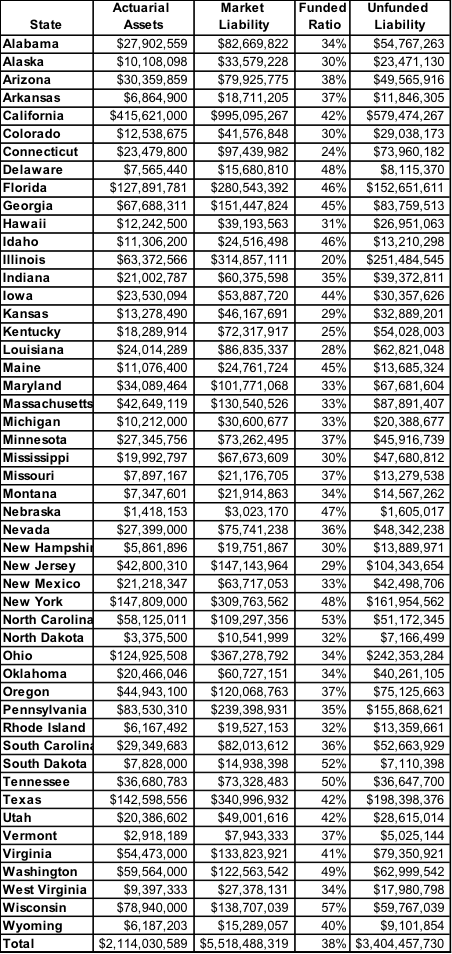

In the wake of public finance debacles like Detroit and important studies of the depth of the problem, the public is becoming aware of the national crisis facing state and local pensions. As ALEC’s recent study, Keeping the Promise: State Solutions for Government Pension Reform, and a recent American Legislator blog post by Kati Siconolfi show, the problem is deep. Nationally, pensions are only 39 percent funded, amounting to a total underfunding figure of 4.1 trillion according to a recent State Budget Solutions Study. The state-by-state results are below:

Thankfully, the public seems to be noticing. The Reason Foundation’s Reason-Rupe poll shows where the public stands on public pension reform and the prospects of pension bailouts:

“Pensions and Detroit

With Detroit’s recent bankruptcy filing, 31 percent of Americans say the federal government should help bail out Detroit, while 65 percent say the federal government should not.

Part of Detroit’s fiscal problems stem from pension and retiree health care costs. When asked what their city should do in a similar budget situation, 73 percent of Americans oppose raising taxes to fund government workers’ retirements. However, 78 percent of Americans support requiring government workers to contribute more towards their own pensions and benefits, and 63 percent favor cutting the benefits government workers receive.”

As more cities grapple with pension problems, Reason-Rupe finds 70 percent of Americans support switching future government employees, who have not been promised benefits yet, from guaranteed pensions to 401(k) retirement plans.”

Though some of these figures decline slightly for millennials, solid majorities of 18-34 year olds still oppose a federal bailout for Detroit (59 percent), oppose raising taxes to fund pension shortfalls (69 percent), favor requiring government workers to contribute more towards their pensions and benefits (73 percent), favor cutting worker benefits (66 percent), and favor moving new retirees into 401(k) retirement plans, known as defined contribution plans (67 percent).

Over at PolicyMic, I make the case that millennials have much to be concerned about regarding the public pension crisis. Arguably, they are the age-group that currently has the largest adverse effect from defined benefit plans, and certainly the group that stands to lose the most in the face of broken defined benefit plans on the state and local level:

“Public pension policy affects millennials’ compensation early in their careers, impacts their ability to switch between the public and private sectors later in their career, and affects the level of public services their state and local governments will be able to provide them in the future for their hard-earned tax dollars.”

Elsewhere, Former State Senator Dan Liljenquist’s ALEC Center for State Fiscal Reform study, Keeping the Promise: State Solutions for Government Pension Reform, has had some outstanding follow-up posts at the American Legislator, and many great stories in the media and other policy organizations. A brief summary of those hits is below:

American Legislator Posts:

- Jonathan Williams and Nick Oswald on the studies release

- Fara Klein on pension reform in Rhode Island

- Ben Winterdink on pension reform in Utah

- William Freeland on pension reform in Michigan

- Andrew Bender on the prospects for pension reform in Illinois

- Nick Oswald on pension reform in Alaska

- Kati Siconolfi on State Budget Solutions’ study on unfunded pension liabilities

Media Coverage:

- Dan Liljenquist in the Desert News

- National Center for Policy Analysis coverage

- Dan Liljenquist writing for State Budget Solutions

- Reason Foundation interview with Dan Liljenquist

- Public Sector Inc. interview with Dan Liljenquist

- Texas Public Policy Foundation coverage

- Texas Public Policy Foundation interview with Jonathan Williams

- Providence Business News coverage

- WPRI 12 News (Rhode Island) coverage

- Illinois Watchdog coverage

- William Freeland’s testimony on “Keeping the Promise” to the Michigan House Financial Liabilities Committee

Model Policy:

- Unfunded Pension Liabilities Accounting and Transparency Act

- Defined-Contribution Pension Reform Act

- Enhanced Integrity in Public Employee Pension Plan Reporting