Archives: State Budgets / Articles

Archives: State Budgets / Articles (page 10)

-

Tax Cut Spotlight Shines Back on the States in State Tax Cut Roundup: 2018

The ALEC Center for State Fiscal Reform recently released State Tax Cut Roundup: 2018, a report featuring the 16 states that substantially cut taxes during the 2018 legislative sessions.

-

A Spark of Hope for New Jersey’s Growing Debt Problem

So long as there are those willing to have “hard and honest conversations” about unfunded liabilities, there is hope for reform.

-

State Legislator of the Month – ND Rep. Craig Headland

Representative Craig Headland was a career farmer before being elected in 2002 to represent and provide real solutions for North Dakota’s 29th district. Since then he has been a steadfast…

-

State Legislator of the Month – WY Rep. Dan Laursen

Representative Dan Laursen was elected to the Wyoming state House in 2014. Since then he continually provides solutions and sets his legislative priorities for those in Wyoming’s 25th district. A…

-

Statement on Stephen Moore’s Selection to Federal Reserve’s Board of Governors

WASHINGTON, D.C. The American Legislative Exchange Council (ALEC) commends and supports Stephen Moore’s selection to the Federal Reserve’s board of governors. As a champion for market-driven solutions and an expert…

-

The Williams Report: January 2019

BUDGET Arizona: Gov. Ducey’s Budget Proposal Adds to Arizona Education Spending Gov. Doug Ducey’s first budget since re-election contains a substantial increase in education spending. Arizona can…

-

The Williams Report: November 2018, Part 2

BUDGET Connecticut: General Assembly Democrats May Need GOP Help to Pass Next CT Budget Connecticut is currently projected to have a $2 billion deficit next budget cycle. The “volatility cap,”…

-

The Williams Report: November 2018

BUDGET Indiana: Hoosiers Will Vote “Yes” or “No” on Balanced Budget Amendment Indiana voters will decide this November whether or not state legislators must pass a balanced…

-

Invasion of the Budget Snatchers: The Looming State Financial Crisis

Like the beginning of a horror movie, the end of a budget process is often bright with people smiling, shaking hands, and congratulating themselves on passing a balanced budget. But…

-

The Williams Report: October 2018, Part 2

BUDGET: Arkansas: Hearings on State’s Budget to Get Going As budget hearings begin, Arkansas legislators will learn the details of programmatic and state agency funding needs, and what Governor…

-

There’s No Better Time for Tax Reform in Virginia than the Present

The Tax Cuts and Jobs Act of 2017 marked the first federal tax reform in more than 30 years. However, Virginia has not made a significant effort to reduce the…

-

The Williams Report: October 2018

BUDGET: Alaska: New State Budget Report Predicts State Savings Accounts Will Be Empty by 2021 Alaska’s persistent funding crisis continues as the state is forced to underfund entitlements and…

-

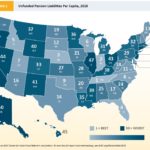

1.1 Trillion Reasons to Remember State and Local Bond Obligations

Note: This Article Originally Appeared in The Hill. We can all agree that we want our states and cities to avoid the painful lessons collectively learned from the recent…

-

The Williams Report, September 2018

Budget: Connecticut: Small Surplus Projected with Current Budget Two months into Connecticut’s fiscal year, the state’s budget chief is projecting a nearly $138 million operating surplus, driven…

-

The Pension Crisis is not a Black Swan Event

Close your eyes and envision a swan. What color is it? Most likely, it is a white swan. Because most of us go our entire lives coming across only white…

-

The Williams Report, August 2018

Budget: Illinois: State Admits to Billion-Dollar Budget Hole The Rauner Administration acknowledged a $1.2 billion structural deficit in an offer to sell $920 million in state bonds.

-

Supreme Court Strikes Down Federal Law that Prevented Gambling On Sports

States now have the authority to legalize sports gambling. The United States Supreme Court struck down the Professional and Amateur Sports Protection Act (PAPSA) on 10th Amendment and anti-commandeering…

-

Ohio State of the State

Governor John Kasich delivered his final State of the State address in an optimistic tone, exclaiming “I believe the state of Ohio is stronger today than it’s been in…

-

Governor Walker’s State of the State: “Getting positive things done for the people of Wisconsin”

Wisconsin Governor Scott Walker delivered his 8th State of the State address in Madison, highlighting his “ambitious agenda” for the 2018 legislative session. Major areas of focus include education,…

-

Trouble in Paradise: Hawaii Governor Ige Acknowledges Livability Concerns

The governor took note of several pressing concerns—energy, affordable housing, education, and income growth. However, many of his solutions threaten to aggravate the underlying problems.