Archives: State Budgets / Articles

Archives: State Budgets / Articles (page 13)

-

Vermont’s State of the State Address Highlights Difficult Hike Ahead

Vermont Governor Phil Scott (R.) exemplified non-partisan, economic realism during his state of the state address. Over the past decade, the state of Vermont has faced extreme economic difficulties, many…

-

Williams Report: Holiday Recap

Budget Connecticut: Official projects Connecticut budget deficit at $224 million Kentucky: Governor Matt Bevin is ordering most state agencies to cut their budgets by 1.3% to cover budget gap.

-

Taxpayers in Every State Bearing Costs of Medicaid Expansion

Was Medicaid expansion a fiscally prudent decision for state governments? As with most sweeping changes, it depends on whom you ask. Medicaid expansion, a part of the Affordable Care Act…

-

The Williams Report

Budget Alabama: Alabama’s general fund ended the year with $34 million more dollars than expected, but in the eyes of many politicians it is as good as…

-

Distinguishing Myth from Reality: The Kansas Tax Reform Effort

Tax policy changes in Kansas have received more media attention than any other state-level fiscal reforms in recent memory – even though many successful pro-growth tax reforms took place in…

-

Spending Growth and Volatile Revenue Trouble in the Treasure State

Montana’s fiscal well-being suffers from two problematic trends: a highly volatile tax structure and a propensity to increase spending. These trends are largely to blame for the projected $227 million shortfall…

-

Proposed Tax Increases Threaten to Stunt Oklahoma Recovery

The Oklahoma legislature is considering tax increases on cigarettes, beer, and fuel, along with doubling the severance tax on new oil and natural gas wells. The estimated…

-

Oregon Triggered by Poor Tax Policy

Oregon taxpayers will receive $464 million worth of their income tax payments back as refundable credits on their 2018 returns, despite the initial $1.8…

-

Alexion, General Electric, Aetna and Others Are Leaving Connecticut for a Reason

The Connecticut legislature moved to raise taxes by about $1.5 billion dollars[i] through new and higher taxes on cell phones, Uber rides, hospitals, hotels and second properties last…

-

West Virginia’s Economic Outlook Improves, Still Behind Most States

In the 10th edition of Rich States, Poor States, West Virginia’s economic outlook improved from 37th to 31st out of the 50 states. This improvement is largely thanks to the…

-

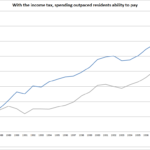

Lessons from Connecticut’s Income Tax: A Cautionary Tale

In 1991, Connecticut implemented a flat income tax of 4.5 percent. The income tax promised to stabilize tax revenues by replacing the volatile state capital gains tax and was to…

-

The Williams Report

Budget Alaska: Alaska looks to diversify their tax revenues but, unfortunately, looks in the wrong place, an income tax. Alabama: Montgomery, Alabama continues to operate without a budget,…

-

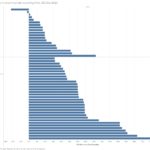

Education Spending and Outcomes

In 2016, the Connecticut Superior Court held that the state failed to uphold its constitutional duty to provide adequate education to children in certain school districts.[i]…

-

The Williams Report

Fiscal: Arizona: Large sales tax increase via ballot initiative proposed for teacher salaries and education funding. California: California Senate Scraps $3 Billion Electric-Vehicle…

-

Taxpayers Score Win as Pennsylvania House Squashes Proposed Tax Hikes

Late Wednesday night, members of the Pennsylvania House of Representatives passed a budget that is free of the onerous tax increases included in previous budgets passed by…

-

The Williams Report

Fiscal: Alabama: Industrial sector growth likely to improve property tax revenues without rate increases in Morgan County, Alabama. Alabama’s State Department of Education is projected to have…

-

Resist the Temptation to Tax Gross Receipts

In the United States, gross receipts taxes (GRTs) had their heyday shortly after the Great Depression as states desperately chased revenue, but by the 1960’s they had nearly disappeared from…

-

The Williams Report

Fiscal: Alaska: Alaska finalizes the state’s capital budget of $1.4 billion dollars, primarily in construction projects. Connecticut: As municipalities face transfer cuts from the State, they ask the governor…

-

The Williams Report

Fiscal: Connecticut: Lt. Governor Breaks Tie in State Senate, Approves Contract for State Workers Democratic Lt. Governor Nancy Wyman voted on party lines to break the tie and pass…

-

VIDEO: Cutting Red Tape in Kentucky

Governor of Kentucky, Matt Bevin, addressing the ALEC 2017 Annual Meeting on the importance of cutting red tape and how Kentucky has worked to make this possible.