Search

Displaying search results

-

Federal and State Leaders Take Promising Steps Towards Protecting Campus Free Speech

In a year dotted with free speech violations and controversies on college campuses, this week officials at both the federal and state level are demonstrating an increased awareness of the…

-

-

Senator Jennifer Fielder

Jennifer Fielder is a State Senator from Thompson Falls, Montana and currently, serves as CEO of the national nonprofit American Lands Council.

-

We Can End the Era of Megafires

Over 10,000 people each year are hospitalized due to wildfire smoke-related heart and lung problems, as many as 2,500 are dying prematurely. Billions of dollars of private and public property…

-

Alexion, General Electric, Aetna and Others Are Leaving Connecticut for a Reason

The Connecticut legislature moved to raise taxes by about $1.5 billion dollars[i] through new and higher taxes on cell phones, Uber rides, hospitals, hotels and second properties last…

-

Jonathan Williams and Joel Griffith Talk Tax Reform

Join ALEC Chief Economist Jonathan Williams and Director of Center for State Fiscal Reform Joel Griffith as they talk tax reform and eliminating the State and Local Tax Deduction.

-

ALEC State Legislators Favor Eliminating SALT Deduction

Hear from State Legislators from around the country on why they favor eliminating the State and Local Tax (SALT) Deduction.

-

The Best and Worst States for Lawsuits

For the past fifteen years, the Institute for Legal Reform has routinely conducted a survey involving corporate litigators and company senior executives. This survey has become a reliable benchmark for…

-

Garland T. McCoy

Garland McCoy has over 30 years experience in technology, communications, Internet and electricity network/grid architecture, cyber-physical security, and policy. Most recently he presented his paper on cybersecurity in networked ICS…

-

ALEC Free Speech Director Advises CA Senate on Protecting Campus Free Speech

Earlier this year, the University of California at Berkley was the scene of violent protests over its campus speakers. In an effort to balance a person’s right to free speech…

-

Newt Gingrich Addresses ALEC Fiscal Responsibility in Higher Education Academy

Newt Gingrich addressed state legislators who gathered from across the country last week at the ALEC Fiscal Responsibility in Higher Education Academy at the George Mason Antonin Scalia School of…

-

A Conversation on Higher Education with Mitch Daniels and Richard Vedder

Last week, state legislators from around the country came together to attend the ALEC Fiscal Responsibility in Higher Education Academy at the George Mason Antonin Scalia School of Law. Purdue…

-

West Virginia’s Economic Outlook Improves, Still Behind Most States

In the 10th edition of Rich States, Poor States, West Virginia’s economic outlook improved from 37th to 31st out of the 50 states. This improvement is largely thanks to the…

-

Bringing Pension Reform to Michigan

ALEC-FreedomWorks State Legislator of the Week This week, ALEC and FreedomWorks introduce Michigan State Senator Phil Pavlov from the 25th district. Pavlov represents Michigan’s Thumb, Huron County, St Clair…

-

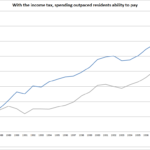

Lessons from Connecticut’s Income Tax: A Cautionary Tale

In 1991, Connecticut implemented a flat income tax of 4.5 percent. The income tax promised to stabilize tax revenues by replacing the volatile state capital gains tax and was to…

-

Louisiana Supreme Court Finds Sentence of Life Without Parole For Juvenile Unconstitutional

The United States Supreme Court held in Graham v. Florida that the Eighth Amendment prohibits juvenile offenders convicted of non-homicide offenses from being sentenced to life in prison without parole. Many…

-

RSVP For The ALEC – Federal Coalition Partners Call

This call will feature updates from the House Ways and Means Committee. You won’t want to miss this opportunity to hear directly from the U.S. House, Senate and White House…

-

National Review: Reagan’s Argument for Eliminating the State and Local Tax Deduction

Read the original article at nationalreview.com. Reprinted with permission. Reagan’s Argument for Eliminating the State and Local Tax Deduction You’ll recall that I’m wary about the GOP…

-

-

State and Local Legislators Urge Congress to Eliminate State and Local Tax Deduction in Exchange for Pro-Growth Lower Rates

"Eliminating the state and local tax (SALT) deduction would provide upwards of $1.5 trillion over the next decade to implement broad-based tax cuts nationally. This overhaul would spur the growth in economic output needed to jolt business investment, personal income growth, and job growth."