Final 2014 Installment of Rich States, Poor States 7th Edition Released

It is the goal of every state legislature to improve the economic conditions of their respective state. However, the practices behind how a state accomplishes this feat have been a subject of debate for years. The beauty of the American political system is that each state can serve as a “laboratory of democracy,” allowing states to learn from the successes and failures of other states. In this respect, the newly released installment of the 7th edition of Rich States, Poor States: ALEC-Laffer State Competitiveness Index serves as an economic journal for states, assessing and analyzing the effects of different policies implemented in different states across the country.

While the federal government in Washington continues to suffer from unprecedented gridlock, state governments are much more dynamic and effective. There is no question that state policy is of the utmost importance in creating an economic atmosphere that allows for the growth of commerce, business, investment and, by extension, prosperity.

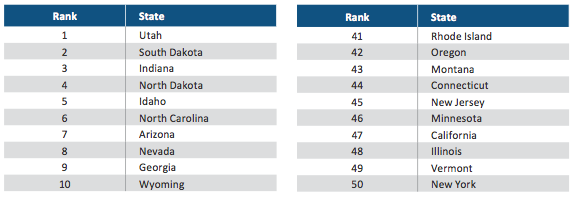

Some fundamental questions that state policymakers should ask themselves include: Why are people leaving California in droves, while Texas is seeing an increase in net migration over the same time period? Why have states like New York lagged in Gross State Product (GSP) growth over the past decade, while states like Utah have enjoyed high levels of growth?

These are some of the many questions that are answered in Rich States, Poor States through an analysis of recent state public policy. The report assesses the economic environment of each of the 50 states in order to determine the key drivers behind the performance of each state’s economy. The result of this analysis is conclusive: The states that promote limited government, free markets and fiscal responsibility enjoy the benefits of healthy and prosperous economies.

As a complement to the previously released state rankings, the final 2014 installment of Rich States, Poor States delves into the recent changes in tax and fiscal policy throughout the states. The report then focuses on the case study of the Northeast, specifically chronicling its economic decline and the policy choices that have led to this severe decline. Finally, the report serves as an economic primer for policymakers interested in understanding why some policies promote economic growth while others hinder it.

It is our hope that this publication will offer some insight into the impact of public policies on respective state economies, spur conversation on what is the best way for a state to achieve economic well-being and serve as a resource for state policymakers to make informed decisions to better the future of their state.