New State Laws Keeping Politics Out of Pensions

A growing number of the “50 Laboratories of Democracy” are leading the way in keeping politics out of pensions – protecting pension beneficiaries and taxpayers alike.

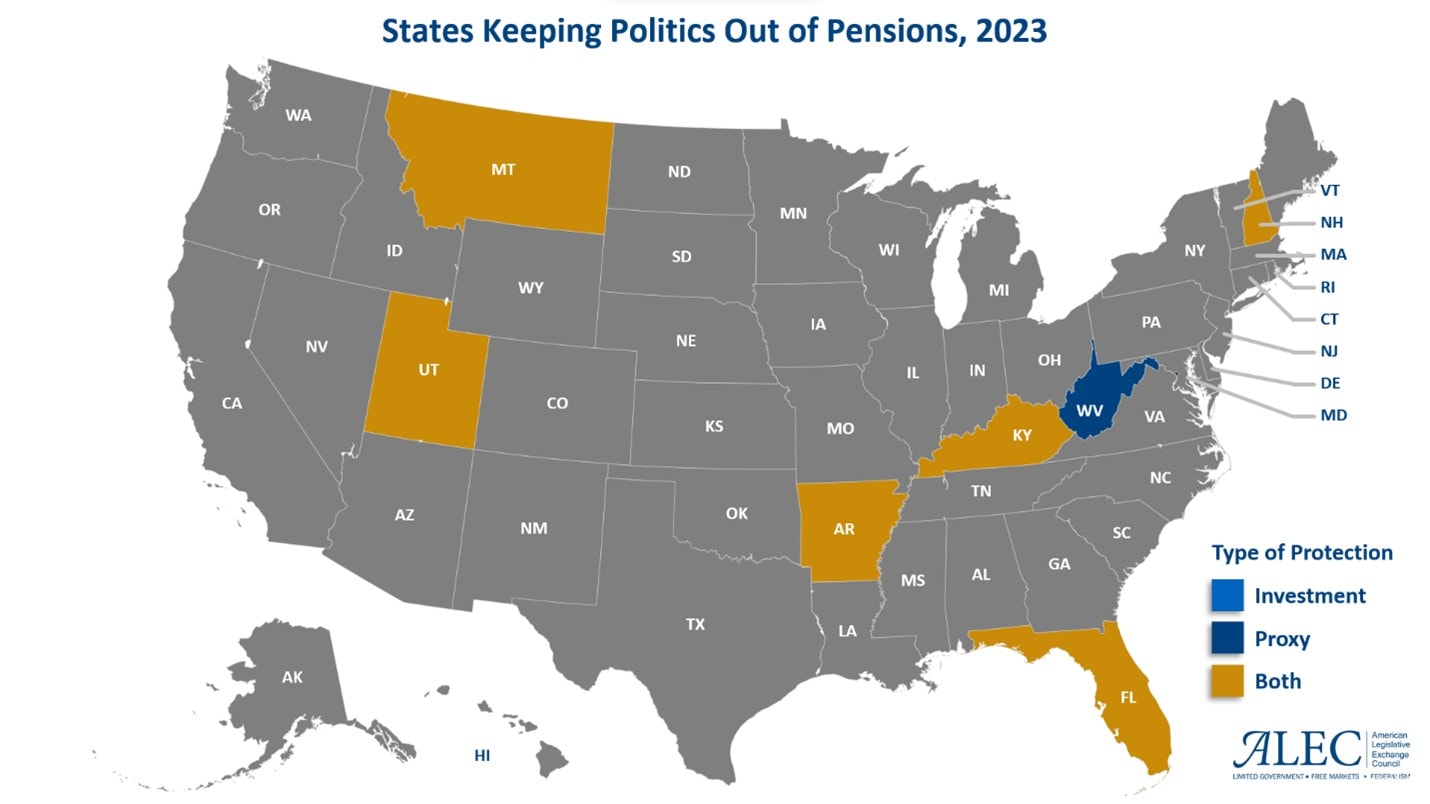

The states are setting the tone for how to protect retirement plans from politically motivated investment strategies. In April, Arkansas Governor Sarah Huckabee Sanders and Montana Governor Greg Gianforte both signed bills in their respective states that require fiduciaries to only consider pecuniary factors when making investment decisions with state pension funds. Following the principles laid out in ALEC’s 2016 publication, Keeping the Promise: Getting Politics Out of Pensions, and the ALEC model policy State Government Employee Retirement Protection Act, Arkansas and Montana have now implemented the gold standard for state fiduciary rules meant to protect public pension plan beneficiaries and taxpayers from the hazards of environmental, social and governance (ESG) investment strategies.

Governors Huckabee Sanders’ and Gianforte’s signatures stand in stark contrast to President Biden’s first veto in March, proving once again that the states are leading the way on sensible free market policy implementation. President Biden’s veto rejected a bipartisan resolution from Congress that would have protected pensions from politicized investment strategies like ESG.

In recent years, some investment firms and state pension systems have taken to these investment strategies to achieve political or social goals rather than maximize returns. They have even used their control of proxy votes to influence company decisions in ways that go against the financial interests of workers and retirees. As ALEC’s Lee Schalk and Thomas Savidge wrote in their op-ed for The Orange County Register:

When lawmakers are allowed to use retirement funds for their own political activism, investment returns suffer, and unfunded liabilities grow at a faster pace. This higher volatility means taxpayers must pay more in pension contributions when investment returns fall short of assumed returns.

The annual ALEC report Unaccountable and Unaffordable estimates state pension plans to be $8.2 trillion in the hole, or $25,000 per man, woman and child in the United States. It’s critical to address these unfunded liabilities rather than make them worse by injecting political crusades.

As Andy Puzder and Mike Edleson explained in The Wall Street Journal, and as ALEC research shows, politicized investing yields lower returns than investing without political constraints – a story that California knows all too well. CalPERS, California’s largest pension system, decided to divest from all tobacco-related stocks in 2001. Two decades later, the tobacco stock divestment has cost California public sector workers and retirees at least $3.5 billion.

Then there’s the Texas story. In 2021, ExxonMobil held a vote to replace four board members that turned into a proxy fight resulting in the placement of three climate activists to the ExxonMobil board of advisors, contrary to the recommendation of the board. It just so happens that the Employees Retirement System of Texas and the Teachers Retirement System of Texas voted their shares for the three new members at the recommendation of Institutional Shareholder Services (ISS). Most pensioners and taxpayers are unaware many public pensions are voting in favor of activist shareholder proposals.

The lessons learned from California and Texas are clear: pension plans and their shareholder votes need to be protected from politically driven decisions. The best way to do this is through the Sole Interest Rule. Fiduciaries should only be permitted to make prudent investment decisions and vote shares in the sole pecuniary interest of plan beneficiaries.

The Arkansas law, sponsored by Representative Mindy McAlindon and Senator Joshua Bryant, and the Montana law follow, authored by pension wizards Representative Terry Moore and Senator Tom McGillvray, both follow this model. They apply the Sole Interest Rule to both investment decisions and proxy votes. In doing so, Arkansas and Montana have set the gold standard for fiduciary rules.

Other states are joining the fight as well. Florida Governor Ron DeSantis signed a similar pension protection bill in early May. After efforts in recent years by State Treasurer Riley Moore to get politics out of pensions, West Virginia has protected its proxy votes by applying the Sole Interest Rule.

Pension protection is proving to be a bipartisan effort as well. Kentucky Governor Andy Beshear signed a pension protection bill into law. In Georgia, the state senate unanimously passed a pension protection bill, and an Oklahoma bill also received bipartisan support.

Despite President Biden’s veto, a growing number of the “50 Laboratories of Democracy” are leading the way in keeping politics out of pensions – protecting pension beneficiaries and taxpayers alike. Stay tuned as we continue to highlight the states that follow ALEC’s Essential Policy Solutions for 2023.