Oklahoma Tax Cuts Back on Track

Oklahoma is back on track to reduce its personal income tax and make sure it remains economically competitive. Last year, Oklahoma legislators voted to reduce the state’s personal income tax from 5.25 percent to 5 percent starting January 1, 2015. There was also a provision to lower the income tax further to 4.85 percent in 2016 if certain revenue targets are met. Governor Fallin signed the measure into law and Oklahoma became one of eighteen states to cut taxes during the 2013 legislative session.

Unfortunately, the tax cut package was ultimately ruled unconstitutional by the Oklahoma Supreme Court. The package included a provision to put aside money for repairs to the State Capitol Building, which violated the state’s single subject rule. The rule, which is law in 41 states, says that each bill can only pertain to a single subject; unlike the behemoth laws that are regularly passed at the federal level. Legislators immediately began to work on legislation to reinstate the tax cuts, but Governor Fallin was originally non-committal as to whether she would support a new tax cut measure.

However, citizens of Oklahoma will be glad to know that the once unsure forecast for tax cuts in the Sooner State has turned around. Tax cut measures have recently been introduced in both the House and Senate. The tax cut package would reduce the personal income tax rate from its current 5.25 percent down to 4 percent by 2018. This would keep pace with neighboring Kansas, which is set to reduce its personal income tax down to 3.9 percent by 2018. Governor Fallin has indicated that, despite her previous reservations, she will support some type of reduction in the personal income tax rate. The move would be very economically beneficial for Oklahoma since it is between Texas, a state having no income tax, and Kansas, one that is rapidly reducing its income tax.

States do not enact (or fail to enact) policies in a vacuum. Each policy decision a state makes has an impact on their state’s economic competitiveness. In order to attract jobs, people, and growing tax revenues, states must remain a desirable place to live, work, and save. Economic data shows that reducing (or eliminating) a state income tax is a great way to make sure that a state becomes or remains competitive.

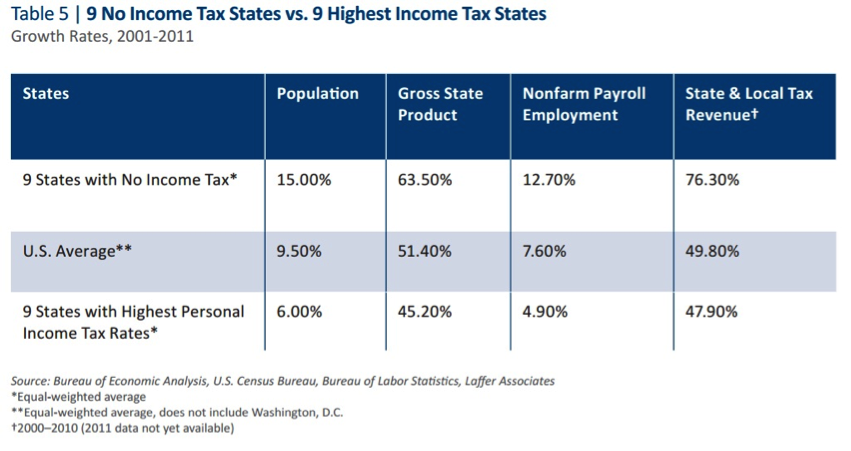

ALEC’s annual Rich States, Poor States economic competitiveness report ranks the states on their economic outlook based on 15 policy variables. The report discusses the importance of reducing the barrier between work and reward—the personal income tax. Over the past ten years, the nine states with no personal income tax have consistently outperformed the nine states with the highest income taxes in almost every area.

The economic data is clear, states without an income tax tend to experience higher rates of economic growth. Kansas has recognized this truth and has been working to cut down its income tax and has been reaping the rewards of that decision. Steve Anderson, the former Budget Director for Gov. Sam Brownback, reported that “The Kansas portion of the Kansas City Metro area gained 9,500 jobs from May 2012 to May 2013 while the Missouri side registered no change in total nonfarm employment over the year.” Additionally, since the tax cuts were passed, Kansas’ unemployment rate has fallen from 7 percent to 5.1 percent (as of November, 2013).

With Kansas gaining ground in the effort to reduce its personal income tax and Texas already at a rate of zero, Oklahoma can’t afford to stand still.