An Examination of State Tax Instruments

All states need to collect revenue if they are to fund the necessary government services that they must provide. While it can be argued what does and does not belong in the category of “necessary government services” the fact remains that whatever belongs in that category must be funded. When it comes to the question of how a state should collect revenue, several mechanisms are available to collect the necessary tax revenue, all with unique attributes and trade-offs associated with them.

Dr. Justin Ross of the Mercatus Center at George Mason University released a new study today, A Primer on State and Local Tax Policy: Trade-Offs Among Tax Instruments, examining the different tax instruments states use to collect revenue. The report critiques four different state tax measurements:

- Individual Income Taxes

- Consumption Taxes

- Real Property Taxes

- Corporate Income Taxes

These four general tax instruments are then examined on the basis of five criteria: economic efficiency, equity, transparency, collectability, and revenue production. These criteria mirror the Principles of Sound Taxation that ALEC maintains as model policy: Simplicity, Transparency, Economic Neutrality, Equity and Fairness, Complementary, Competitiveness, and Reliability.

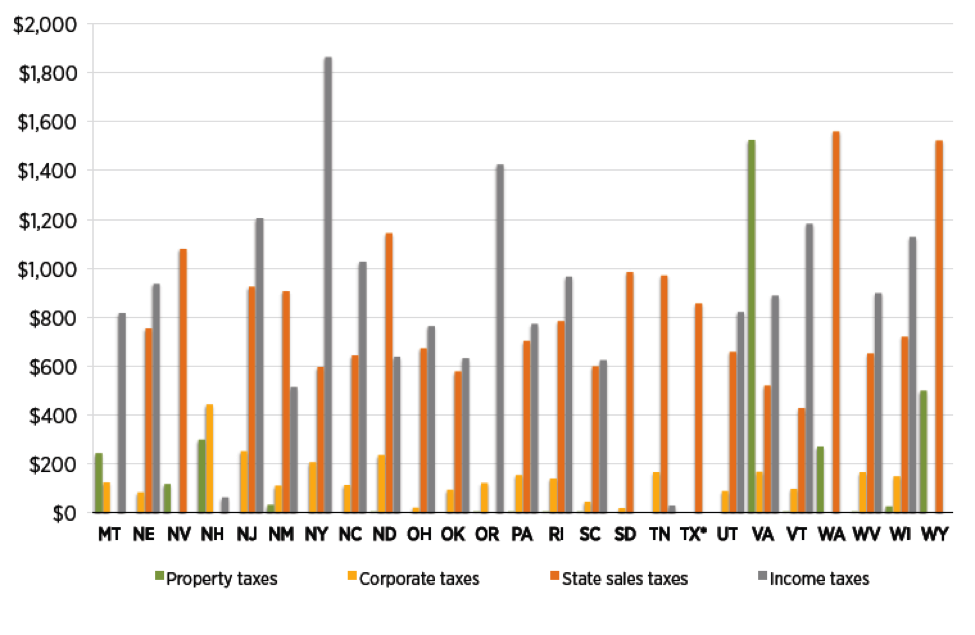

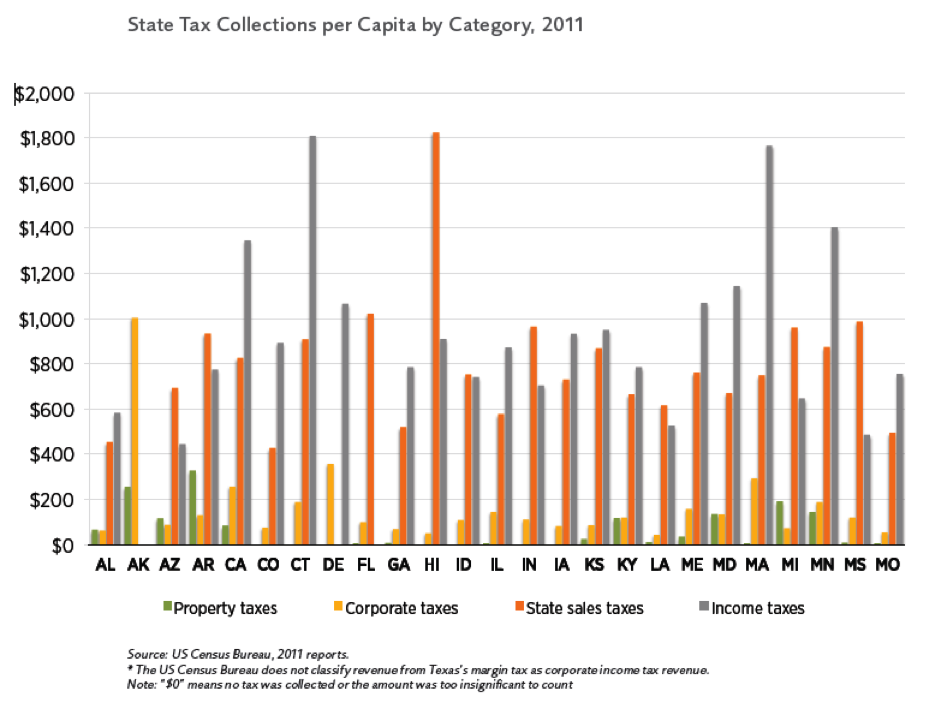

The report does an excellent job of laying out the pros and cons of each tax instrument in the context of the five criteria. The appendices also contain useful information on state-by-state tax collection per-capita and from each tax instrument. See the charts below.

In addition to its usefulness as a policy primer on state tax instruments, the report also makes some conclusions that are certainly worth repeating:

“One recurring theme throughout each of these instruments is that there is no perfect tax that is unambiguously desirable because the criteria often conflict with one another. A second theme is that every tax instrument can be made worse through poor design. Policy advocates following good tax principles should have little trouble continuously finding areas of improvement in their own environment.”

As states continue to raise the necessary revenue needed to fund essential government programs, policymakers should recognize that certain tax instruments have trade-offs and that not all taxes are created equal.