The Laffer Curve Takes its Toll in Maryland

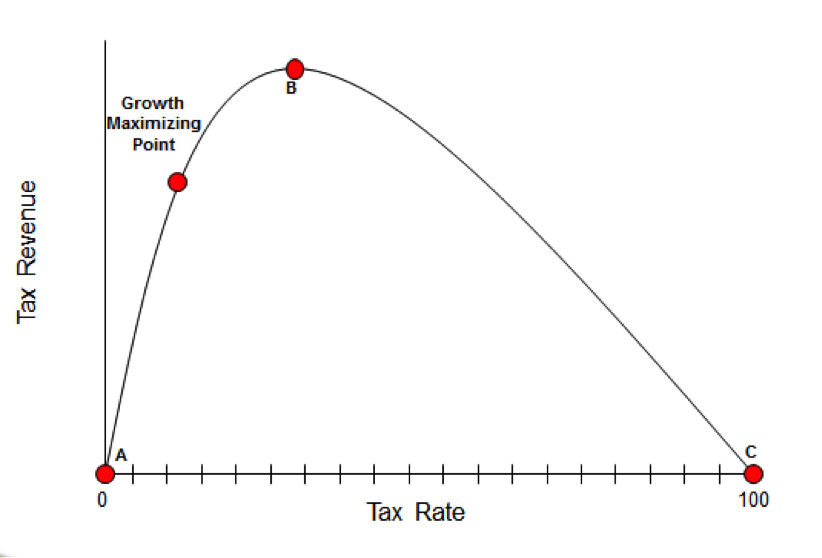

The idea that lowering tax rates can lead to higher revenue collections from increased economic activity is not a new one. Nor is this observation unique to tax policy. A business may lower the price of a good and see a higher profit as many more people choose to purchase that good for the cheaper price. But Arthur Laffer, an economist in the Reagan administration and co-author of ALEC’s Rich States, Poor States report, is credited with popularizing this idea through his “Laffer Curve.”

However, many advocates of ever-increasing tax rates accuse promoters of this common sense principle as only wanting to lower taxes for the wealthy or believing in “voodoo” economics. But every once in a while, reality forces an admission that the principle exists, and even its most ardent detractors cannot ignore the basic laws of economics.

Douglas Gansler, the current Attorney General of Maryland, recently commented on his plan for increasing the amount of drivers on an under-utilized Maryland toll road, the Inter-county Connector (ICC). His solution is to cut the current toll price by 50 percent (for drivers that use the road at least 15 times per month) in an effort to increase the amount of drivers that utilize the road. According to a recent article, “Gansler said the loss in toll revenue would be offset by additional motorists using the ICC as a result of his proposed discount.”

This is one solution that is being seriously considered for increasing the amount of people using the ICC. Meanwhile, proposals to cut tax rates to spur additional business investment, saving, and consumer spending are still laughed off as wacky ideas by the liberal policy-makers in Maryland.

Of course, not all tax cuts “pay for themselves,” and different taxes affect economic growth more than others. But the connection between lower taxes and higher rates of economic growth is undeniable. Taxes on income are far more economically damaging than taxes on consumption, although all taxes hinder economic growth to some extent. In fact, the nine states without an income tax saw their tax revenues grow by 76.3 percent from 2001 to 2011. By contrast, over the same period, the nine states with the highest income taxes saw revenues grow by just 47.9 percent. Perhaps, after the irony sinks in, decision-makers in Maryland will examine the evidence and choose economic growth.