Archives: Tax Reform / Articles

Archives: Tax Reform / Articles (page 12)

-

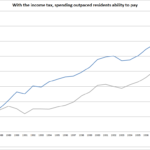

Lessons from Connecticut’s Income Tax: A Cautionary Tale

In 1991, Connecticut implemented a flat income tax of 4.5 percent. The income tax promised to stabilize tax revenues by replacing the volatile state capital gains tax and was to…

-

National Review: Reagan’s Argument for Eliminating the State and Local Tax Deduction

Read the original article at nationalreview.com. Reprinted with permission. Reagan’s Argument for Eliminating the State and Local Tax Deduction You’ll recall that I’m wary about the GOP…

-

Support for Soda Tax Fizzles in Cook County

Tax-and-spend proponents have a serious problem when even the greater Chicagoland area, long known as a city that soaks taxpayers, heeds citizen uproar and moves to repeal a tax. The…

-

For High-Octane Growth, Exchange the State and Local Tax Deductions for Lower Income Tax Rates

Eliminating the state and local tax (SALT) deduction would provide upwards of $1.5 trillion over the next decade to implement broad-based tax cuts nationally. This overhaul would spur the growth…

-

Jonathan Williams Joins the Tim Jones Radio Show

Chief Economist and Vice President of the Center for State Fiscal Reform joined the Time Jones Radio Show this past weekend. Jonathan talked federal tax reform.

-

Erica York: Redskins Camp is a Bad Deal for RVA Taxpayers

As the Washington Redskins “broke training camp” at their state-of-the art facility, the city of Richmond is going broke paying for it all.This year marks the fifth season the football…

-

ALEC Applauds Federal Tax Reform Framework

As a nation, we have fallen behind in competitiveness – just by standing still. As the rest of the world has reduced taxes on employers, our job creators pay some…

-

Jonathan Williams Explains Why America Needs Tax Cuts Now

The ALEC Tax team joined How Money Walks, Job Creators Network and small business owners from across the country in front of the Internal Revenue Service to rally for tax…

-

Taxpayers Score Win as Pennsylvania House Squashes Proposed Tax Hikes

Late Wednesday night, members of the Pennsylvania House of Representatives passed a budget that is free of the onerous tax increases included in previous budgets passed by…

-

Jonathan Williams Sits Down with Genevieve Wood of The Daily Signal

Jonathan Williams joins Genevieve Wood of The Daily Signal at The Heritage Foundation to discuss ALEC and the Center for State Fiscal Reform.

-

Arkansas Fumbles the Ball With Fantasy Sports Tax

Rotisserie league and general fantasy sports betting contests have existed for decades. With the internet, now millions can compete in daily and season-long fantasy sports contests, often with entry fees…

-

Chief Economist Jonathan Williams on Wichita Liberty TV

Chief Economist Jonathan Williams sits down with Bob Weeks of Wichita Liberty TV to discuss the ALEC mission and recent work.

-

VIDEO: Cutting Red Tape in Kentucky

Governor of Kentucky, Matt Bevin, addressing the ALEC 2017 Annual Meeting on the importance of cutting red tape and how Kentucky has worked to make this possible.

-

VIDEO: Cut Taxes, Save States

Former Speaker, Newt Gingrich, addressing the ALEC 2017 Annual Meeting on the importance of implementing tax cuts before taking on true reform in each state.

-

North Carolina Accelerates Broad-Based Tax Relief

By further lowering economically destructive taxes on productivity, North Carolina lawmakers are giving the state’s economy yet another long-term boost, further magnetizing its draw for individuals and businesses alike.

-

Illinois Must Dig Itself Out Of The Fiscal Ditch

Finger-pointing is rampant in Illinois as the state’s credit rating has been downgraded by S&P and Moody’s to near junk status, the lowest ever for a state. Without…

-

State of the State: Illinois

From Illinois’ crushing taxes and regulations to the state’s fiscal problems, it is easy to see why people are voting with their feet and leaving the state at disproportionately high rates. If the Land of Lincoln wishes to stop the bleeding, Governor Rauner can’t be the only one with good ideas—members of the General Assembly and the general public need to get behind necessary reform efforts to save the state.

-

Taxes, Pensions and Free Speech On Display in Salt Lake City

The ALEC Center for State Fiscal Reform recently hosted a successful regional Tax and Fiscal Policy Academy, with Utah legislative hosts Senator Wayne Niederhauser, Senator Stuart Adams and Representative Kim…

-

What’s the Matter with Kansas Republicans?

When you travel down I-70 west from the Kansas City airport to the Kansas capital of Topeka, you pass a sign that says “You Are Entering the Land of Oz.”…

-

United States House of Representatives Committee on Ways and Means Written Testimony

Dear Chairman Brady, Ranking Member Neal, and Members of the Committee, Thank you for the opportunity to comment throughout this important policy discussion. By way of background, my name is…