7 Things Every American Needs To Know About Taxes

Today is tax day in America. As always, it features a lot of confusion with tax forms, some rushed trips to the post office and a whole lot of heartburn as taxpayers are reminded just how much they paid in taxes over the previous year. Despite the fact that every American constantly is affected by local, state and federal taxes, there is still a large number of Americans who don’t know about taxes. Here are seven things many every American should know about taxes.

1. Taxes Cost a Whole Lot

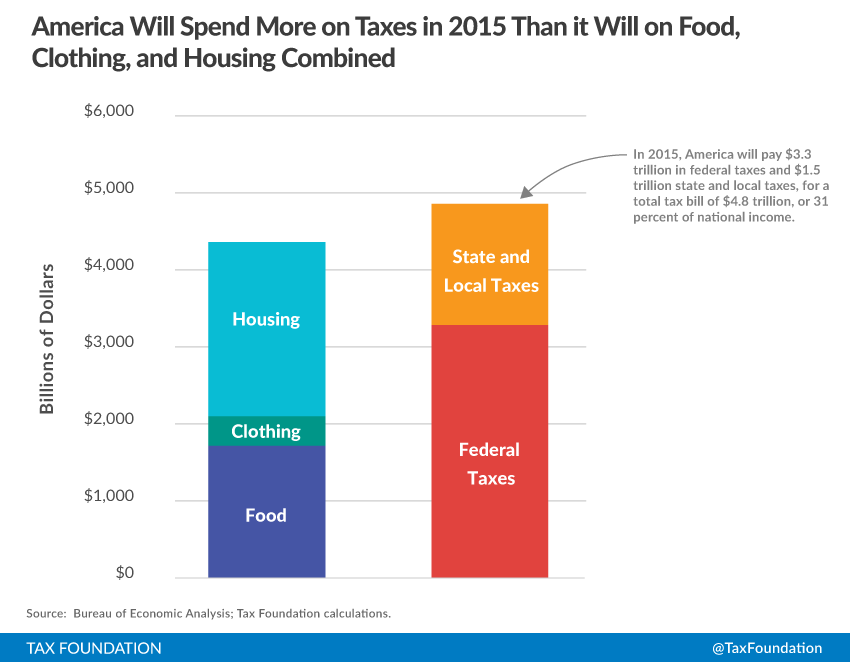

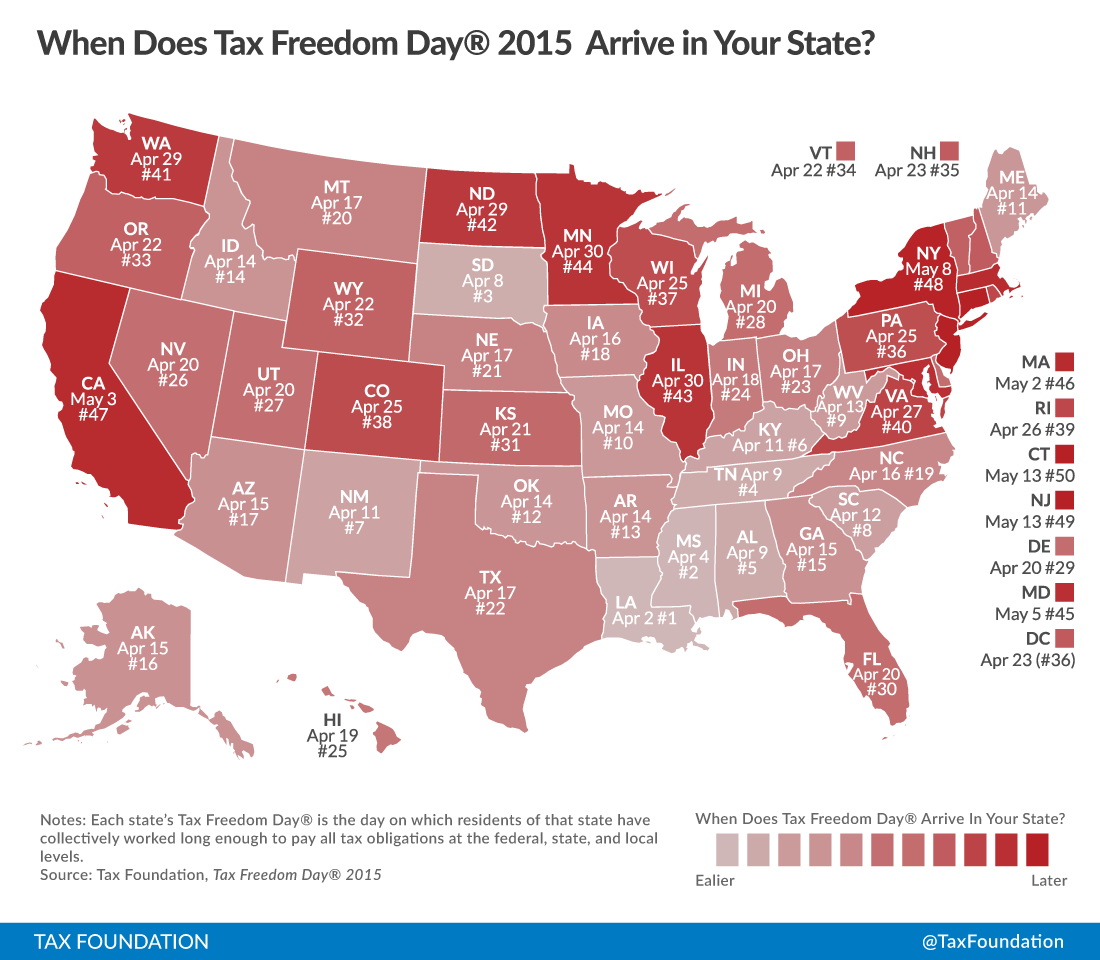

Taxes on all levels consume over a quarter of gross domestic product annually, which is roughly defined as the entire economic production of the nation in a given year. This totals in at $4.8 trillion dollars. It’s not a modest or trivial amount, as most taxpayers have known all too well. According to the Tax Foundation, the average American will work till April 24th to pay their share of taxes in 2015, a day the Tax Foundation rightly titles “Tax Freedom Day.” That means that the average American will work nearly 31 percent—just short of a third of a year—to pay their tax burden on all levels. Put differently, Americans spend more on average on taxes at all levels than food, clothing and housing combined.

Of course this varies widely by state, given the differences between state tax codes. The map below shows the respective “Tax Freedom Day,” which includes local, state, and federal taxes, for all 50 states.

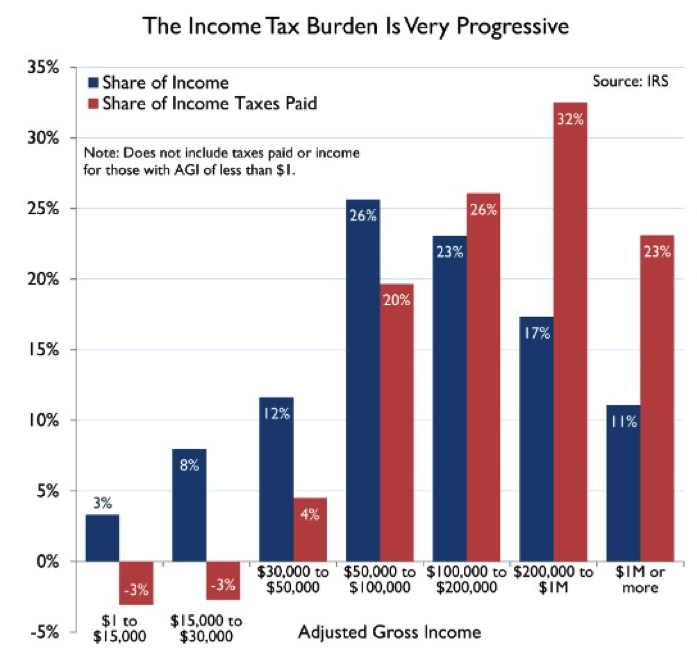

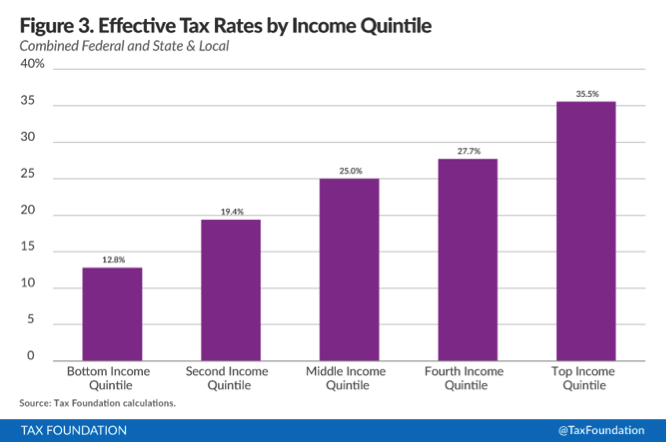

Not all taxpayers pay the same amount in taxes, at least as a percentage of income. The two charts below compare federal income taxes to income earned by income group, and then the burden of all taxes (local, state, federal) by income group.

2. Taxes Vary Widely Between the States

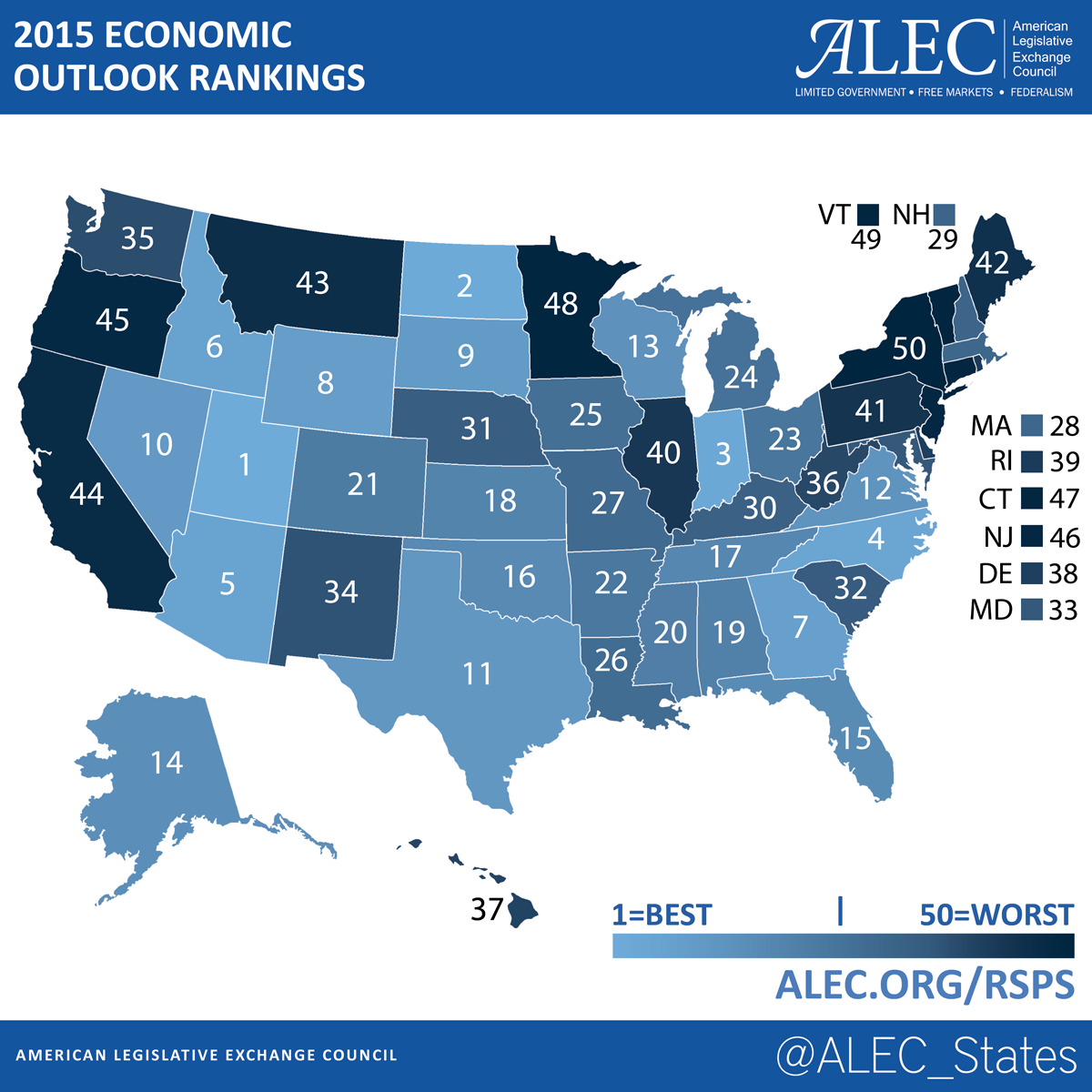

All state and local tax codes are not created equal. They rely on different taxes more heavily, tax at different levels and structure their tax codes quite differently. The annual ALEC study, Rich States, Poor States, measures each state’s public policy climate in terms of the extent it embraces free market and limited government policies. As such, the study focuses heavily on state tax burden. The 8th edition for 2015 was recently released and the states rank as follows:

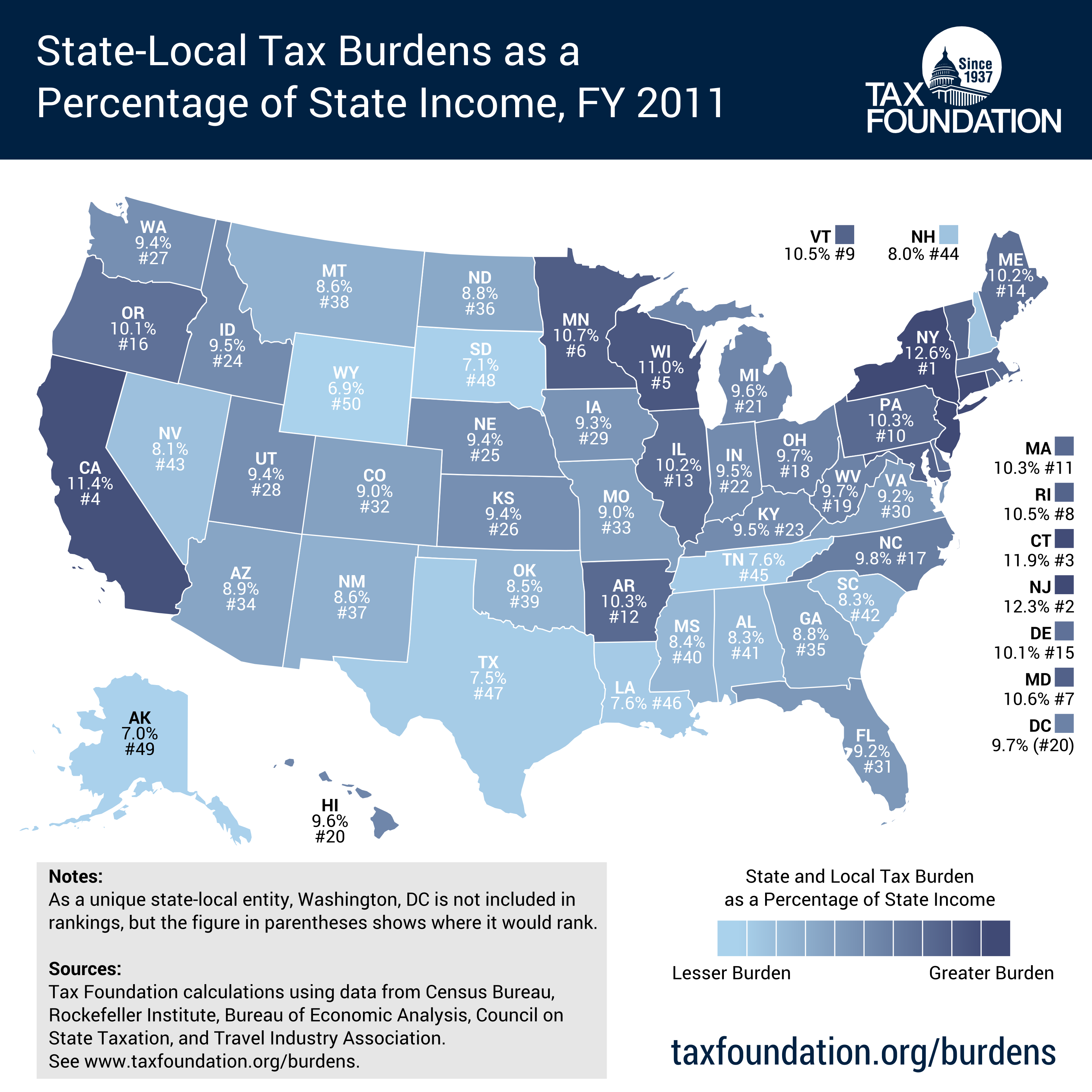

Focusing more narrowly on state and local tax burdens, the Tax Foundation calculates the total state and local tax burden as a percentage of state income. Given the lag of data, fiscal year 2011 is the most recently available, although 2012 is likely soon to be released given past publication schedules. The differences in total state tax burdens as a percentage of total state income can be seen directly below.

3. We Don’t Tax Enough for All We Spend

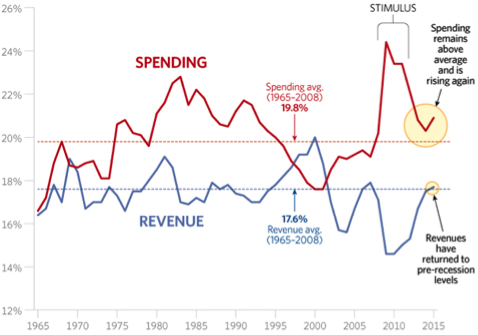

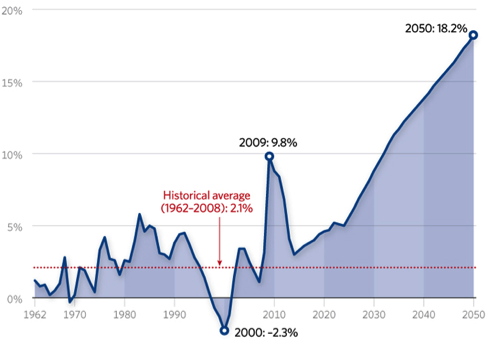

Though America taxes quite a lot of income (see above), federal taxation doesn’t nearly cover all federal spending. In recent years, the federal spending deficit has fallen due to budgetary reforms. But that’s been the exception, not the norm. Moreover, the federal deficit is projected to increase unsustainably in future decades due to overspending. The two charts below from the Heritage Foundation shows the federal deficit over time, first comparing spending to revenues, and then looking at the deficit figure in isolation.

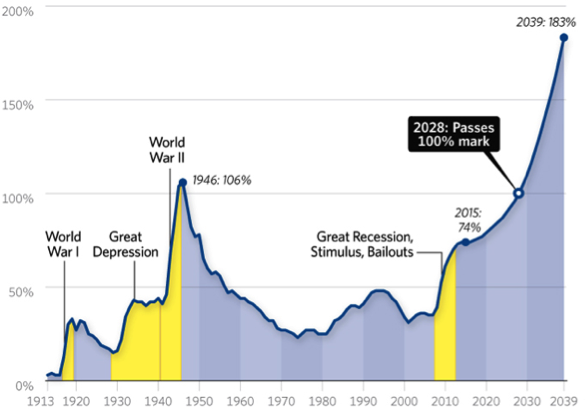

All this deficit spending has amounted to a massive federal debt, which can be seen below, also from the Heritage Foundation, which includes current debt and projections.

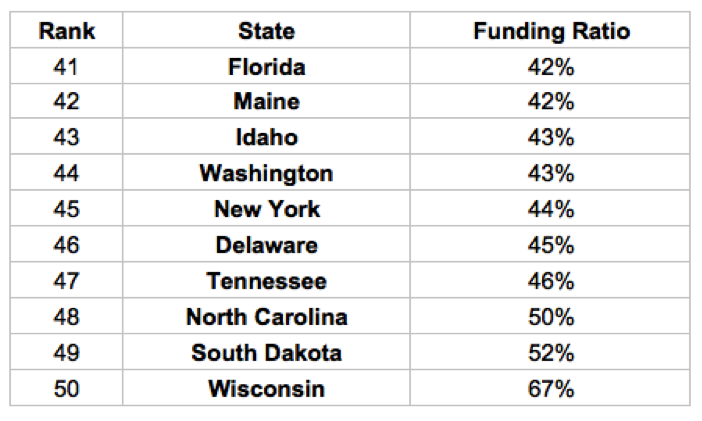

Budget deficits are not a sole feature of the federal government, despite the fact that most states have balanced budget requirements. Most concerning is state pension debt, which has reached $4.7 trillion dollars in unfunded liabilities, according to State Budget Solutions. The top and bottom ten states in pension debt can be viewed below.

4. Taxes Affect Incentives and Economic Performance

Taxes affect economics growth, particularly taxes on income. Citing studies from a range of reputable sources, including President Obama’s own former council of economic advisers, Dr. Pozdena and Dr. Fruits highlight the wealth of historical evidence in agreement with the theoretical case. This evidence establishes the proven negative effects of taxation on economic growth and investment. This includes national level studies, as well as those studies that analyze state level difference in tax policy and economic performance. Utilizing IRS taxpayer migration statistics, the research presented in Tax Myths Debunked proves that tax rates matter when decisions about where to locate one’s family or business arise.

Similar to the efforts of Dr. Pozdena and Dr. Fruits, Dr. William McBride at the Tax Foundation analyzed the evidence on how taxes affect economic growth in a study titled, “What is the Evidence on Taxes and Growth.” Dr. McBride’s findings are substantial:

“In this review of the literature, I find twenty-six such studies going back to 1983, and all but three of those studies, and every study in the last fifteen years, find a negative effect of taxes on growth. Of those studies that distinguish between types of taxes, corporate income taxes are found to be most harmful, followed by personal income taxes, consumption taxes and property taxes.”

A follow-up report by Dr. McBride found that roughly 90 percent of studies found taxes indeed harm economic growth. Perhaps most staggering is the size of the effect of taxes on GDP. Christina Romer, a former chief economic adviser to President Obama, along with her husband David Romer, found:

- Each 1 percent increase in taxation lowers real GDP by 2 to 3 percent.

- These damaging effects on the economy are persistent and are not diminished by offsetting changes in prices.

- Investment falls sharply in response to tax increases. It is very likely that this strong retreat of investment is part of the reason the declines in output are so large and persistent.

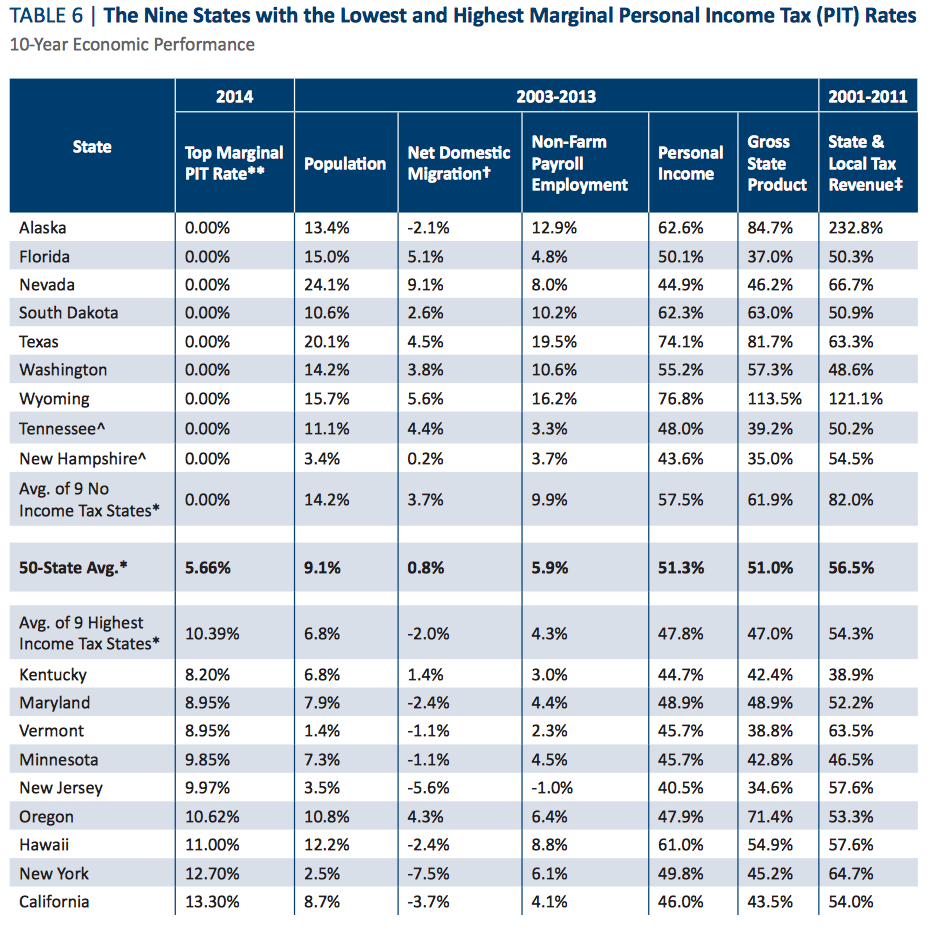

The economic case that income taxes in particular negatively affect growth rests on the notion that taxes lower the return for productive activity like work, production and innovation. Lowering the return to such productive activity—activity which often involves substantial difficulty and sacrifice—leads people to engage in that activity less frequently. Moreover, those businesses and highly talented individuals with the greatest ambition and will to succeed are likely to take their opportunity or talent to greener pastures—states or nations with more favorable business climates. This can be seen most clearly comparing the economic performance of the 9 states with no income tax with the 9 states that have the highest income tax:

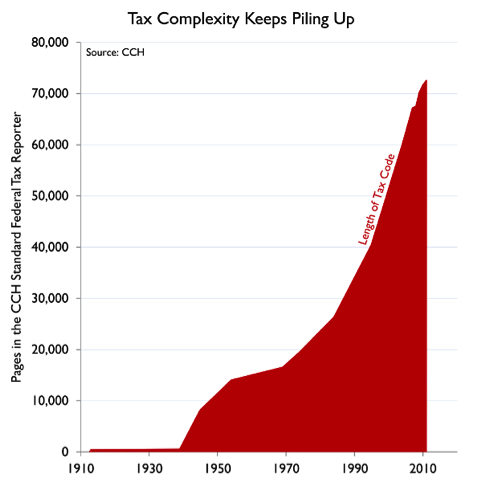

5. Taxes Are Costly to Comply With in the United States

As former House Ways and Means Chairman Dave Camp has pointed out in The Wall Street Journal, “According to Nina Olsen, the National Taxpayer Advocate at the IRS, Americans overall spend over six billion hours and $168 billion every year to file their returns.” He follows this revelation up by noting that the federal tax code “is now 10 times the size of the Bible, but with none of the Good News.” And this is before even considering the cost of state compliance with all taxes. The length of the federal tax code tells the story, as reported by the Tax Foundation.

Moreover, these figures don’t account for the full cost of compliance for a taxpayers, individual and business, of complying with all taxes on the local, state and federal level. Tax compliance doesn’t come cheap.

6. Taxes Favor Some at the Expense of Others

As the recent ALEC report titled “The Unseen Costs of Tax Cronyism: Favoritism and Foregone Growth” notes, tax policy that is poorly structure or unfair can tilt the competitive playing field massively. The paper notes:

“Policymakers looking to enhance economic prosperity in their states face two diametrically opposed strategies with respect to their tax codes. They can embrace low, broad-based taxes with zero or minimal carve-outs and special preferences. This approach, referred to by this paper as growth through markets, provides all businesses, large and small, with an equal opportunity to grow. On the other hand, policy makers can embrace cronyism by providing certain businesses and industries with special targeted tax breaks and tax carve-outs. The growth through central planning approach gives some businesses an unfair advantage over others.

The stakes of getting this policy choice right are high. States that follow the growth through markets approach create an economic environment that encourages job growth, income growth, entrepreneurial opportunity and broadly shared prosperity.

Cronyism—the perversion of sound economic policy to create a system that benefits one firm or industry at the expense of all others—is a serious public policy problem. Cronyism in tax policy is no exception. It stifles competitive tax policy by precipitating tax rate increases on the firms not in favor with policymakers, subverts market outcomes for inferior economic planning, and introduces a deep temptation for public corruptions.”

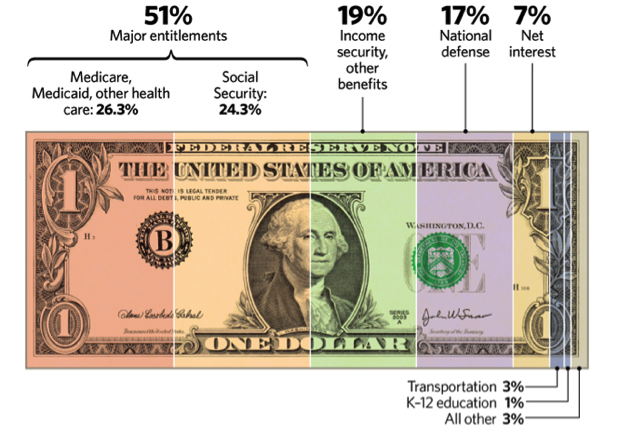

7. Where Does All The Money Go?

The Heritage Foundation has broken down where federal spending goes in terms of various federal policy objectives. Their analysis can be seen below.

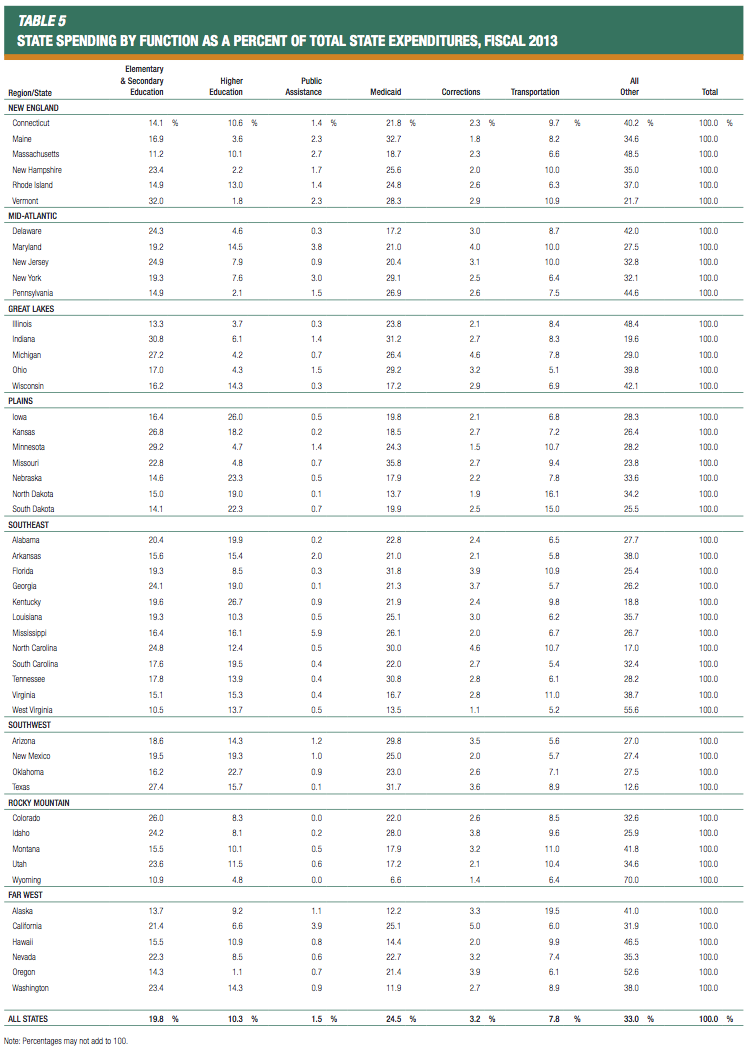

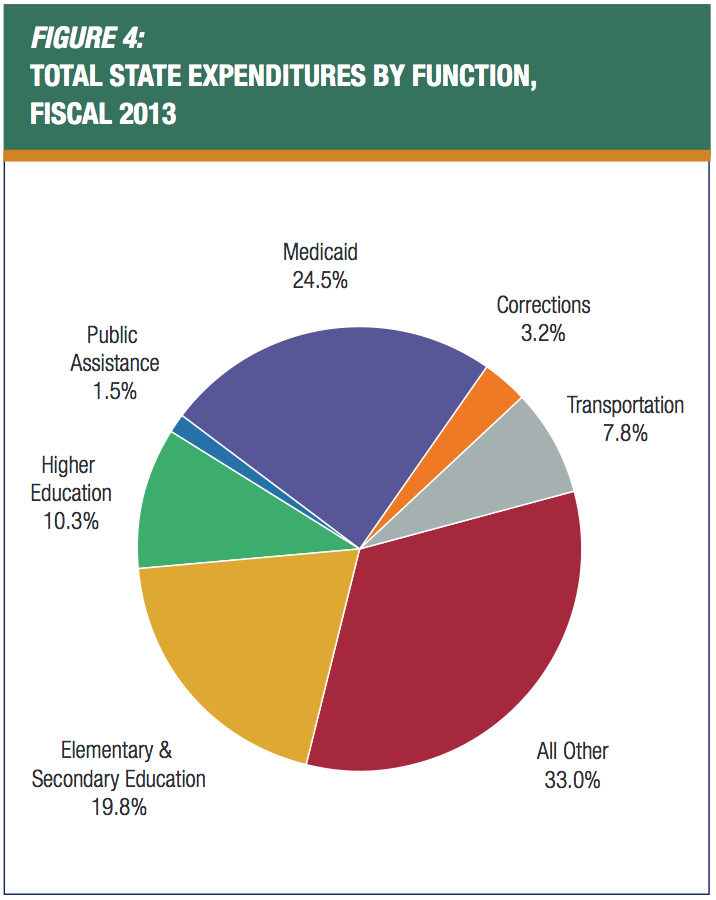

On the state and local level, the National Association of State Budget Officers has the results. You can see their analysis below, both in aggregate and by state.

In conclusion, Tax Day in America is a great reminder of how taxes impact work, savings and investment. Principled tax policy outlined in the ALEC Principles of Tax Policy—broad bases and low competitive rates—can provide every American with greater economic opportunities. We hope that the federal government can learn a few lessons from the states on innovative tax reform.