Archives: Tax Reform / Articles

Archives: Tax Reform / Articles (page 16)

-

Speaker Ryan, Chairman Brady Propose Pro-Growth Tax Reform for Congress

Fundamental tax reform has eluded Congress since the Reagan administration, but that is not stopping some members from proposing sweeping relief for our overburdened economy. As part of his “A…

-

Even Governor Jerry Brown Admits Income Taxes Destabilize State Budget

For many years, Rich States, Poor States, Tax Myths Debunked and other ALEC publications have warned against over-reliance on state level income taxes...

-

Philadelphia Embraces Discriminatory Taxation

"This is not the narrative that had been told to the public."

-

Tax Code Shaken, Economic Outlook Not Stirred

A common argument put forth by proponents of tax-and-spend schemes is that pro-growth tax reforms are a guaranteed way for a state to destroy its bond rating.

-

Spending Cuts and Tax Reform: Not ‘Heads’ or ‘Tails’

Insofar as state fiscal policy goes, taxes and spending are permanently linked as two sides of the same coin.

-

Growth in the Desert

By abandoning the tax-and-spend playbook and prioritizing sound budgeting, state officials and legislators continue to help Arizona separate itself from economically overburdened states like Illinois, Connecticut and Pennsylvania.

-

VIDEO: Jonathan Williams on Common Sense Rhode Island

In the latest edition of Rich States, Poor States: ALEC-Laffer Economic Competitiveness Index, Rhode Island placed 39th in terms of economic outlook.

-

Gross Receipts Tax Threatens Job Growth and Economic Opportunity in Oregon

Oregon families deserve economic policies that increases opportunity and rewards entrepreneurship.

-

Four Things Other New England States Are Doing Worse Than Maine

New England, on the whole, is an economically-depressed region.

-

A Taxpayer Exits New Jersey – And the State Panics

A single taxpayer’s exodus from high-tax New Jersey sent the Garden State’s budget office into a tailspin.

-

AUDIO: Jonathan Williams Talks Rich States, Poor States with Financial Journalist Andy Busch

Williams noted that states with taxpayer-friendly, market-oriented economic policies are increasingly winning both jobs and residents...

-

Hall Tax Repeal Will Benefit Tennessee’s Economy

Repealing the Hall Tax not only incentivizes investment, the lifeblood of business, but also contributes to economic growth by allowing Tennesseans to keep more of their own money.

-

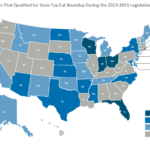

Rich States, Poor States: Tracking Nine Years of State Domestic Inversions

The trend of international corporate inversions is the most recent high-profile indicator that taxes matter for economic development and job creation, but that signal is hardly the first to do so.

-

AUDIO: Money and Politics in Delaware

In the latest Rich States, Poor States: ALEC-Laffer Economic Competitiveness Index, Delaware fell six spots – down from 38th place last year to 44th place this year.

-

More Than Half of Prince’s Estate May Go Towards Paying Death Tax Bill

The coming battle over Prince’s estate serves as a lesson to taxpayers: do not die in Minnesota.

-

Is RI-Innovates Corporate Cronyism in the Best Interests of Ocean State Families?

Part of the RI Innovates plan is designed to give away taxpayer-funded subsidies to many of the same industries targeted by a similar in the Empire State, called Start-Up NY.

-

Drop in ALEC Ranking Due to Spending, Not Tax Cuts

In the recently released ninth-annual “Rich States, Poor States” report, many states saw their rankings move considerably. Among them was Kansas, which fell from its 2015 economic…

-

VIDEO: Rich States, Poor States

Jonathan Williams, co-author of the report and vice president of the ALEC Center for State Fiscal Reform, discussed the new rankings with Mary Kissel on The Wall Street Journal Live.

-

Rich States, Poor States: Maine Gets Richer, but Still Among the Poorest

In the recently-released ninth edition of the Rich States, Poor States: ALEC-Laffer State Economic Competitiveness Index, Maine earned its highest all-time rank of 38.

-

Why The Left And Others Fear Fundamental State Tax Reform

The 2016 election cycle is in full swing, and so is the campaign to scare citizens and policymakers away from honest examination of tax reform ideas across the states. According…