Tag: Tax & Fiscal Policy

Tag: Tax & Fiscal Policy

-

Administration’s Budget Reins In Spending, Predicts Enhanced GDP Growth

The President’s Budget for Fiscal Year 2018 outlined an ambitious pro-growth agenda—addressing discretionary as well as entitlement spending. The $4.1 trillion budget for fiscal year 2018 is a slight increase…

-

Taxes Matter—Yes, in Georgia Too

With gridlock continuing to delay the first fundamental federal tax reform since 1986, states are leading the way. Recognizing that tax policy has the power to make or break an…

-

State of the State: Florida

Ceaseless efforts crafting pro-growth tax and fiscal policies have created a prosperous and competitive economic environment in the Sunshine State. Even brighter times lie ahead should lawmakers let economic resources…

-

State of the State: Alabama

Alabama Governor Robert Bentley’s many racing metaphors in his State of the State address attempted to convey his commitment to an Alabama with better jobs, economic growth and education. But…

-

State of the State: Tennessee

If lawmakers agree to the spending-heavy budget plan touted by Governor Bill Haslam, Tennesseans will pay more at the pump but could save more while shopping and could earn a tuition-free…

-

Spooky, Scary Pension Fund Skeletons

If states want to keep their pension plans healthy, and avoid a virtual apocalypse of the pension undead, reform is indispensable.

-

ALEC Center for State Fiscal Reform Event in North Dakota

ALEC Center for State Fiscal Reform Vice President Jonathan Williams traveled to North Dakota last week for an in-depth discussion of the state’s economy. Williams joined the Greater North Dakota…

-

Nickel and Diming Innovation to Death

The Commonwealth of Massachusetts is creating a new tax on Transportation Networking Companies (TNCs) to the tune of $0.20 per ride. Of the $0.20, five cents, or a full jitney nickel, will go to none other than the taxi industry itself.

-

For Economic Opportunity, the Redder the Better

Many of America’s bluest states are deep in the red thanks to tried-and-failed progressive policies. The Illinois General Assembly can’t pass a long-term budget deal, leading to significant losses…

-

Speaker Ryan, Chairman Brady Propose Pro-Growth Tax Reform for Congress

Fundamental tax reform has eluded Congress since the Reagan administration, but that is not stopping some members from proposing sweeping relief for our overburdened economy. As part of his “A…

-

A Congressional Proposal for “A Better Way”

During a recent address in the United States Capitol’s Statuary Hall, Speaker of the House Paul Ryan and other congressional leaders outlined “A Better Way,” a series of policy proposals mostly…

-

Resolution In Support of Ending Unauthorized Federal Spending

WHEREAS, the national debt has increased to alarming levels, and, WHEREAS, according to the Congressional Budget Office (CBO) there is more than $310 billion of unauthorized appropriations for fiscal year…

-

Growth in the Desert

By abandoning the tax-and-spend playbook and prioritizing sound budgeting, state officials and legislators continue to help Arizona separate itself from economically overburdened states like Illinois, Connecticut and Pennsylvania.

-

Gross Receipts Tax Threatens Job Growth and Economic Opportunity in Oregon

Oregon families deserve economic policies that increases opportunity and rewards entrepreneurship.

-

VIDEO: Rich States, Poor States

Jonathan Williams, co-author of the report and vice president of the ALEC Center for State Fiscal Reform, discussed the new rankings with Mary Kissel on The Wall Street Journal Live.

-

Rich States, Poor States: 9th Edition Released

On Tuesday, the American Legislative Exchange Council (ALEC) Center for State Fiscal Reform released the ninth edition of the Rich States, Poor States ALEC-Laffer State Economic Competitiveness Index rankings. The…

-

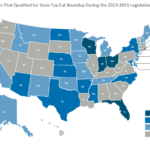

2016 State Economic Competitiveness Index Reveals National Pro-Growth Trend

North Carolina, North Dakota, Wyoming and Arizona among top states; New York, Vermont, New Jersey, Connecticut and California rank last

-

Filtering out the Myths Supporting Cigarette Taxes

If the concern of state officials is with the public welfare, the choice is clear. Based on the empirical data collected from other states, increasing cigarette taxes will chill commerce, burden small businesses, damage employment rates and do little for public health.

-

ALEC Alumni Address Taxpayers’ $310 Billion Unauthorized Appropriations Problem

Recently, ALEC alumnus and House Budget Committee Chairman Tom Price (GA) joined ALEC members on a conference call to discuss free market solutions to federal budget challenges. Congressman Price discussed…

-

State of the State: Oklahoma

Governor Fallin has traditionally been an ally of limited government, free markets and federalism. However, given the difficult economic circumstances that her oil-dependent state is suffering, the governor and legislature are in a trying position.