Archives: State Budgets / Articles

Archives: State Budgets / Articles (page 12)

-

Kansas State of the State: Gov. Brownback Resists Tax Hikes, Calls for Constitutional Amendment on Ed Financing

The governor’s rejection of a tax increase is welcomed news for taxpayers. Just last year, legislators overrode his veto in order to enact an enormous tax increase of $1.2 billion over the next two years alone. This tax hike on individuals and businesses wiped out much of the tax reductions from the 2012 reforms. Avoiding a new tax increase, pushing for a voter-approved constitutional amendment on school financing, and demanding educational reforms will help avoid compounding the damage from last year’s tax hikes.

-

The Williams Report

Budget Alabama: The Alabama Senate passed a $2 billion dollar general fund budget. The increase is due primarily to $51 million dollars of additional appropriations to the Department of…

-

Governor Baker Highlights Tax-Hike Free Budget and Accomplishments

Massachusetts Governor Charlie Baker delivered his third State of the State address, highlighting the states’ successes and challenges over the past three years and his administration’s plans…

-

Governor Hogan Aims to Reduce State Taxes in Response to Federal Tax Reform

Governor Larry Hogan delivered his fourth State of the State address at the end of January. The largely positive address condemned hyper-partisanship, highlighted the economic improvements that coincided with state…

-

Oregon State of the State: Governor Brown Demands Spending on Pet Projects, Neglects Needed Reforms

In her recent State of the State Address, Governor Kate Brown kicked off Oregon’s short 35-day legislative session with a litany of policy proposals, all in her…

-

Arizona State of the State: Confidence and Conviction, Promise and Possibility

Arizona Governor Doug Ducey delivered a sunny State of the State address, highlighting the “capacity of our state, and its people, to always be ahead of the…

-

California State of the State: A High Speed Train of Taxes and Spending

California Governor Jerry Brown boldly championed an unabashedly liberal agenda throughout his 16th—and final—State of the State address. The governor declared, “California is prospering,” a stark turnaround from the economic…

-

The Williams Report

Budget Alaska: Gov. Bill Walker aims to reduce state spending by 1.7 percent, eliminating over 200 positions. Arizona: Arizona Gov. Doug Ducey released his…

-

Michigan State of the State: A Comeback Story

Fortune is changing in the state of Michigan following decades of extreme economic adversity, from the rapid downturn in the auto industry to the downward population spiral in Detroit. Governor…

-

Kentucky State of the State: Governor Bevin Commits to Tax and Pension Reform

Kentucky had an eventful legislative session last year after the state house switched party control for the first time since 1921, resulting in a Republican trifecta. During…

-

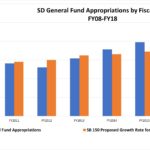

South Dakota Legislative Proposals Would Dramatically Reform Spending, Provide Stability, & Deliver Tax Relief

Two pieces of legislation working their way through the South Dakota legislature could provide spending restraint along with property tax relief for residents. The first is SJR 5, which is…

-

Missouri State of the State: Government Should “Do Fewer Things and Do Them Better.”

The Show-Me State’s 2018 legislative session is off to an exciting start, as Eric Greitens begins his second year as Missouri governor. His inaugural session in office focused heavily on…

-

Nebraska State of the State: Tax Reform on the Horizon

Last year, Nebraska Governor Pete Ricketts (R.) received the American Legislative Exchange Council annual “Best of the Best” award for his bold, pro-growth oriented State of the…

-

South Dakota State of the State: Mixed Agenda of Pro-Growth Regulatory Reform but Possible Tax Hikes

South Dakota Governor Dennis Daugaard’s 2018 State of the State focused on workforce development, public education, occupational licensing reform, a possible transportation tax increase and support for overturning legal precedent…

-

Idaho State of the State: Governor Otter Celebrates Economic Strength, Advocates for Modest Tax Cuts in Final Year

In his twelfth and final state of the state address, Governor C.L. “Butch” Otter celebrated Idaho’s continued strengths. “Our State government is leaner, more fiscally responsible, more transparent, more responsive,…

-

West Virginia State of the State: Governor Justice Changes His Tune on Tax Hikes

In his 2018 State of the State Address, West Virginia Governor Jim Justice (R.) lamented last year’s failed push for higher taxes, saying “It was really unfair…

-

Indiana State of the State Address

The Hoosier State has implemented commendable changes regarding tax and fiscal policy in the past several years, with strong leaders at the helm including Governor Eric Holcomb, and former Governors…

-

Florida State of the State: Governor Scott Calls for Supermajority Requirement for Tax Hikes

In an emotional final State of the State address January 9, Florida Governor Rick Scott began by thanking the people of Florida for the opportunity granted him…

-

The Williams Report

Budget National: States in For Fiscal Crises Without Reining in of Irresponsible Spending. California: Despite Warnings of Recession, Gov. Brown’s Budget Proposal Massively Hikes…

-

Iowa Governor’s Condition of the State Address Promises Bold Tax Reform

Iowa Governor Kim Reynolds delivered her first Condition of the State address last week in Des Moines. Reynolds served as Lieutenant Governor under former Governor Terry Branstad.