Tag: Taxation

Tag: Taxation (page 2)

-

New Hampshire State of the State Address

One of the youngest governors in the nation, Governor Chris Sununu, recently delivered his second State of the State address. He focused on New Hampshire’s unique strengths and commented,…

-

New Jersey Inauguration: Governor Murphy Claims the Moral High Ground in Bid to Expand Government

Governor Murphy failed to recognize that those on the other side of the aisle may share the same ultimate policy outcome goals—justice, fairness, and growth—albeit with far different policy preferences. This threatens to block pragmatic bipartisan progress on numerous pressing issues.

-

The Williams Report

Budget National: S&P finds tariffs could hurt state, city budgets Alabama: The Alabama Senate delivers a general fund budget to the governor’s office. Alaska: To avert shutdown…

-

Colorado State of the State: Hickenlooper’s Pursuit of Taxes

The governor is right that “by almost any measure, we’ve become one of the best places for business in America.” But expanding crony capitalism and increasing the tax burden make maintaining this coveted status more difficult. Following five consecutive years in the top 10 for economic outlook in Rich States, Poor States, Colorado dropped to 16th in 2013 and has failed to fully recover. A sharpened focus on regulatory reform and pension reform are required to guarantee continued success in the Centennial State.

-

Kansas State of the State: Gov. Brownback Resists Tax Hikes, Calls for Constitutional Amendment on Ed Financing

The governor’s rejection of a tax increase is welcomed news for taxpayers. Just last year, legislators overrode his veto in order to enact an enormous tax increase of $1.2 billion over the next two years alone. This tax hike on individuals and businesses wiped out much of the tax reductions from the 2012 reforms. Avoiding a new tax increase, pushing for a voter-approved constitutional amendment on school financing, and demanding educational reforms will help avoid compounding the damage from last year’s tax hikes.

-

Arizona State of the State: Confidence and Conviction, Promise and Possibility

Arizona Governor Doug Ducey delivered a sunny State of the State address, highlighting the “capacity of our state, and its people, to always be ahead of the…

-

California State of the State: A High Speed Train of Taxes and Spending

California Governor Jerry Brown boldly championed an unabashedly liberal agenda throughout his 16th—and final—State of the State address. The governor declared, “California is prospering,” a stark turnaround from the economic…

-

Michigan State of the State: A Comeback Story

Fortune is changing in the state of Michigan following decades of extreme economic adversity, from the rapid downturn in the auto industry to the downward population spiral in Detroit. Governor…

-

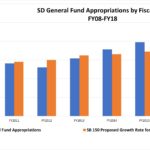

South Dakota Legislative Proposals Would Dramatically Reform Spending, Provide Stability, & Deliver Tax Relief

Two pieces of legislation working their way through the South Dakota legislature could provide spending restraint along with property tax relief for residents. The first is SJR 5, which is…

-

Missouri State of the State: Government Should “Do Fewer Things and Do Them Better.”

The Show-Me State’s 2018 legislative session is off to an exciting start, as Eric Greitens begins his second year as Missouri governor. His inaugural session in office focused heavily on…

-

South Dakota State of the State: Mixed Agenda of Pro-Growth Regulatory Reform but Possible Tax Hikes

South Dakota Governor Dennis Daugaard’s 2018 State of the State focused on workforce development, public education, occupational licensing reform, a possible transportation tax increase and support for overturning legal precedent…

-

The Williams Report

Budget National: States in For Fiscal Crises Without Reining in of Irresponsible Spending. California: Despite Warnings of Recession, Gov. Brown’s Budget Proposal Massively Hikes…

-

Proposed Tax Increases Threaten to Stunt Oklahoma Recovery

The Oklahoma legislature is considering tax increases on cigarettes, beer, and fuel, along with doubling the severance tax on new oil and natural gas wells. The estimated…

-

For High-Octane Growth, Exchange the State and Local Tax Deductions for Lower Income Tax Rates

Eliminating the state and local tax (SALT) deduction would provide upwards of $1.5 trillion over the next decade to implement broad-based tax cuts nationally. This overhaul would spur the growth…

-

Education Spending and Outcomes

In 2016, the Connecticut Superior Court held that the state failed to uphold its constitutional duty to provide adequate education to children in certain school districts.[i]…

-

Taxpayers Score Win as Pennsylvania House Squashes Proposed Tax Hikes

Late Wednesday night, members of the Pennsylvania House of Representatives passed a budget that is free of the onerous tax increases included in previous budgets passed by…

-

Arkansas Fumbles the Ball With Fantasy Sports Tax

Rotisserie league and general fantasy sports betting contests have existed for decades. With the internet, now millions can compete in daily and season-long fantasy sports contests, often with entry fees…

-

North Carolina Accelerates Broad-Based Tax Relief

By further lowering economically destructive taxes on productivity, North Carolina lawmakers are giving the state’s economy yet another long-term boost, further magnetizing its draw for individuals and businesses alike.

-

Resolution Urging Congress to Cut the Federal Corporate Tax Rate

Model Resolution: WHEREAS, it is the mission of the American Legislative Exchange Council to advance Jeffersonian principles of free markets, limited government, federalism, and individual liberty, and WHEREAS, at a combined federal-state…

-

State of the State: Illinois

From Illinois’ crushing taxes and regulations to the state’s fiscal problems, it is easy to see why people are voting with their feet and leaving the state at disproportionately high rates. If the Land of Lincoln wishes to stop the bleeding, Governor Rauner can’t be the only one with good ideas—members of the General Assembly and the general public need to get behind necessary reform efforts to save the state.